We partner with renowned distilleries offering rare, sought-after whiskey, or emerging ones prioritizing quality over quantity with promising growth potential.

PRIVATE WHISKEY CLIENTS

Samuel Gordon , Co-Founder & CEO

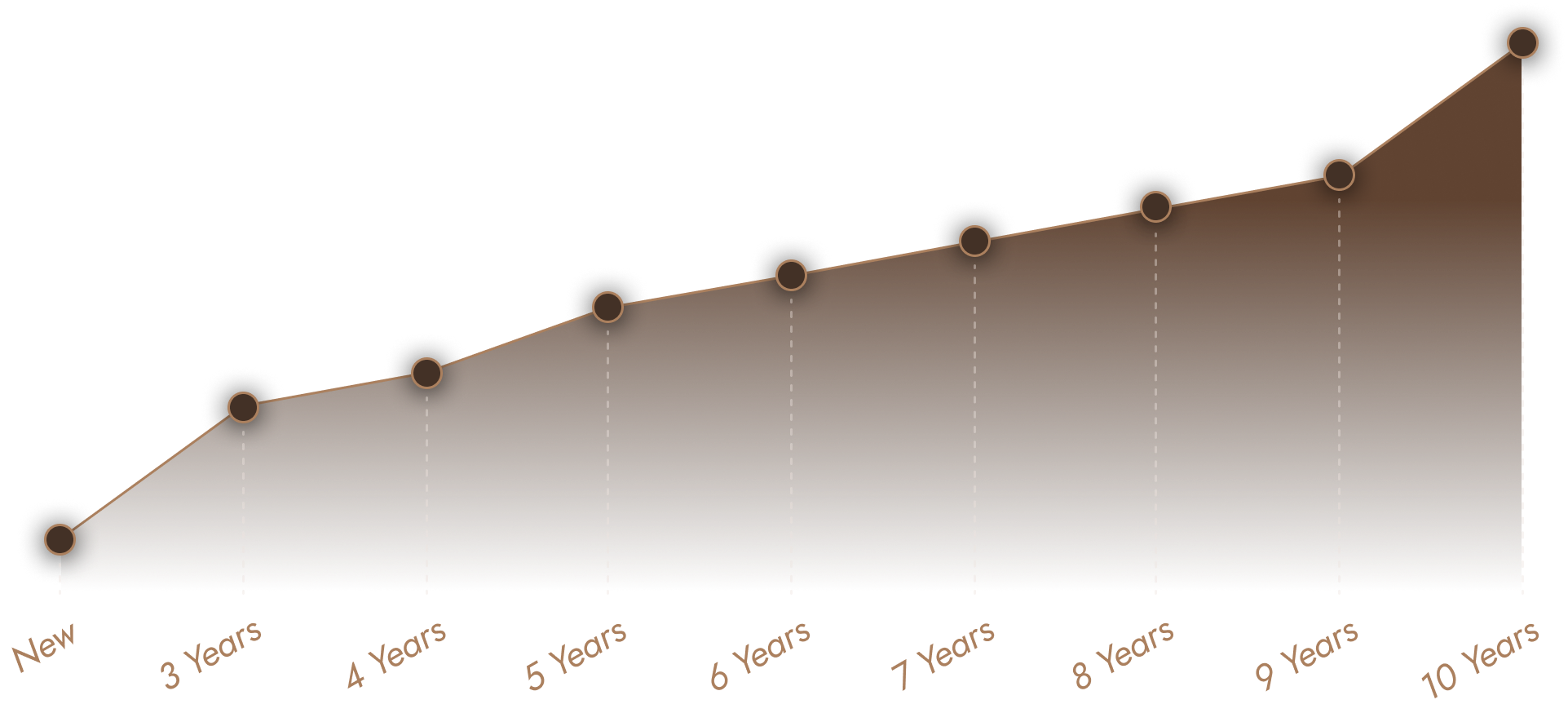

Samuel Gordon , Co-Founder & CEO Older whiskey is highly valued for its exceptional quality, evolving over time to develop richer, more complex flavors within the cask.

As most whiskey is typically bottled young, the scarcity of aged cask whiskey is amplified, further enhancing its allure and value.

This rare combination of exceptional quality and scarcity serves as a driving force for our clients to invest in casks of new make spirit.

By allowing these casks to mature in bonded warehouses, our clients can capitalize on the appreciation of aged whiskey and sell at peak value.

Prices shown are for Annandale’s spirit maturing in ex-bourbon barrels.

We partner with renowned distilleries offering rare, sought-after whiskey, or emerging ones prioritizing quality over quantity with promising growth potential.

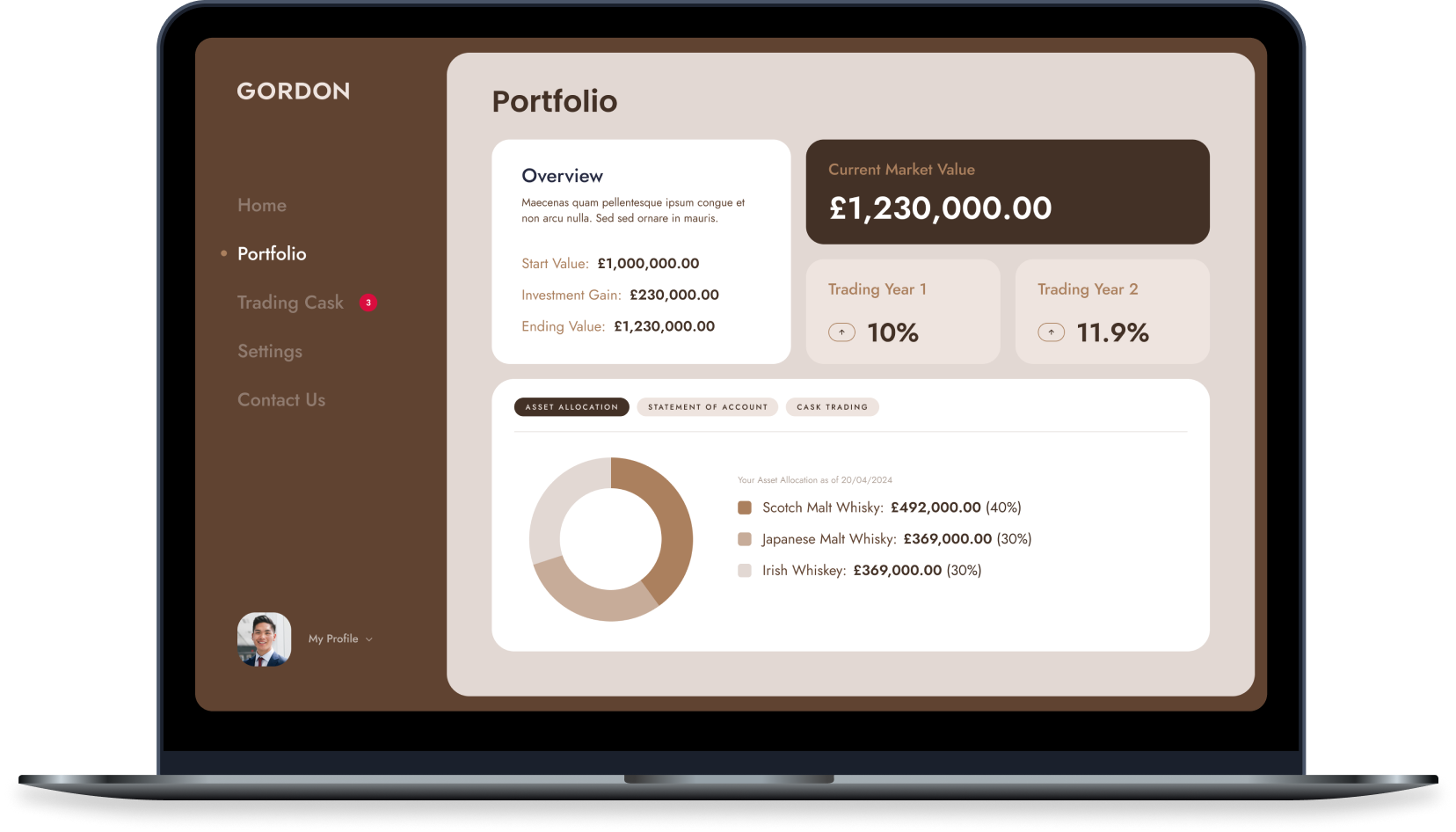

We’re at the forefront of the whiskey investment market, bringing in a clear and simple approach with our cutting-edge investment platform.

As the CEO of GORDON PWC, I’ve had the privilege of tasting some of the finest whiskies out there, and Japanese…

At GORDON PWC, we are committed to offering premium spirits that showcase exceptional craftsmanship and quality….

When it comes to alternative investments, both wine and tequila offer unique opportunities, but they differ in key…

Our clients choose us for several compelling reasons:

We offer Direct Asset Ownership: Simplified and transparent management of cask whiskey assets.

Access to Exclusive Opportunities: Rare whiskey casks not available to the general public.

Tailored Client-Centric Monetization: Real-time valuations and personalized monetization strategies.

For investments made in the United States:

Under U.S. law, GORDON’s cask whiskey investments are categorized as “securities” due to various factors, including investor interest and our marketing approach. To ensure compliance, GORDON relies on the exemption outlined in Rule 506(c) of Regulation D under the U.S. Securities Act of 1933. This exemption mandates that U.S. purchasers meet SEC-defined “accredited investor” criteria, a requirement independently verified by GORDON.

This framework is structured to provide regulatory adherence and offers U.S. investors a structured opportunity. However, it’s crucial to understand the associated risks, including the speculative nature of such investments, potential discontinuation of past performance trends in price appreciation, and the limited liquidity as there is no guarantee of a secondary market for reselling. Detailed risk information is provided in investor subscription documents, the sole means for U.S. investors to acquire cask whiskey investments from GORDON.

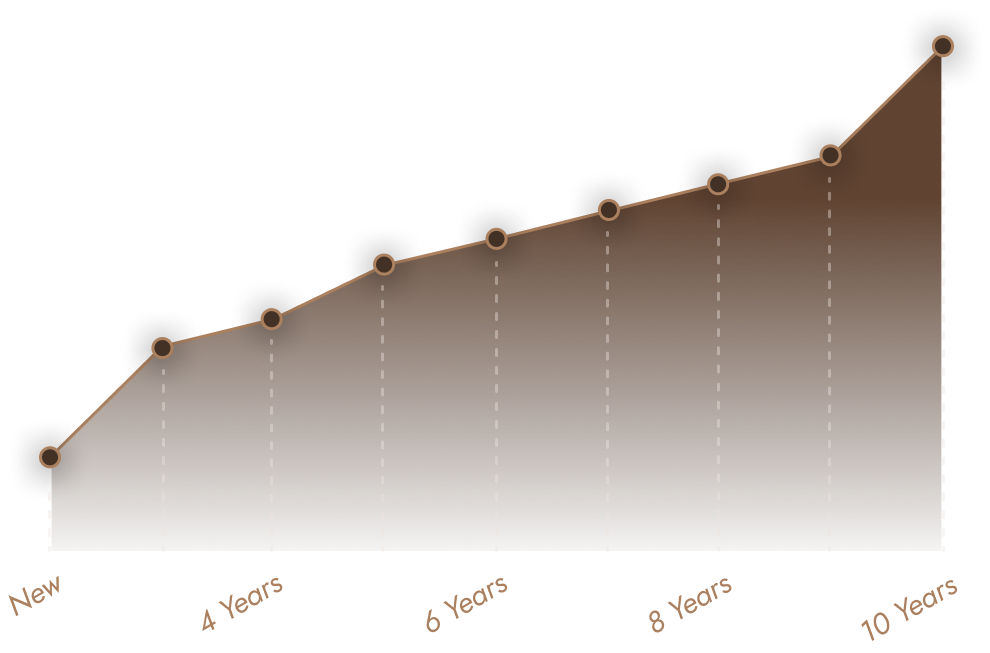

Older whiskey develops exceptional quality and richer flavors in the cask over time.

As most whiskey is bottled young, the scarcity of aged cask whiskey increases its allure and value.

This rare combination of quality and scarcity motivates our clients to invest in casks of new make spirit.

By maturing these casks in bonded warehouses, clients can maximize the appreciation of aged whiskey and sell at peak value.

Distilleries sell casks to raise capital for whiskey production, which is capital intensive and requires a long production process.

Traditionally, casks were only sold to industry insiders, and distilleries relied on bank loans during aging, which can span 3 to 30+ years.

Economic shifts, like high inflation and rising interest rates, have made lending challenging. Brokers now offer access to a global network of buyers, creating new capital-raising avenues and investment opportunities for distilleries.

Cask whiskey investment is primarily suitable for individuals who can commit funds for five to ten years or longer and are comfortable with that timeframe.

Your casks will be stored in your own private account at the distillery’s government bonded warehouse, serving as your custodian.

A government bonded warehouse is a secure storage facility where goods like whiskey can be stored without paying taxes until they are ready for sale.

In Scotland, Japan, and Ireland, cask whiskey is aged tax-free until maturity, facilitating cost management and quality control for distilleries throughout the aging period.

When acquiring a cask whiskey portfolio, you’ll obtain a signed delivery order addressed to the warehouse keeper from the seller.

This document is then sent to the distillery’s warehouse keeper to update records, confirming your ownership directly.

The warehouse keeper can only process requests, like ownership transfers, from the listed cask owner.

Indeed, obtaining a Delivery Order (DO) is crucial as it confirms the transfer of casks from the seller to the buyer’s warehouse account.

The warehouse keeper needs official confirmation from both parties to record the transaction accurately and issue ownership confirmation to the new owner.

Offshore clients classified as ‘revenue traders’ must appoint a duty representative, an onshore company with an active WOWGR license, to handle reporting to the warehouse keeper on their behalf.

You’re likely considered a revenue trader if you buy cask whiskey with the intent to profit or own more than 5 casks, according to HMRC.

Absolutely, everything is taken care of for you.

As a GORDON Private Whiskey client, you enjoy total control and transparency through a seamless process.

Our account management service covers everything from initial setup to ongoing oversight and assistance with the resale of your cask whiskey portfolio.

For more information on our service, please contact one of our consultants.

Investing in casks of whiskey carries specific risks, such as:

Limited liquidity: This investment is most suitable for investors who can commit funds for five to ten years or longer and are comfortable with this timeframe. There is no guarantee of a secondary market for reselling.

Uncertain price appreciation: There’s no guarantee that the whiskey’s value will increase, as it depends on economic factors such as whiskey supply and demand.

For a comprehensive list of risks, please refer to the subscription agreement.

Your casks will be covered by the insurance policy of the bonded warehouse.

Sell your casks anytime through the platform by requesting a sale or accepting a bid offer.

Our whiskey managers will guide you on opportune selling moments to maximize profits.

Our portfolio managers negotiate sales with diverse buyers, including independent bottlers, brokers, distilleries, and investors.

Alternatively, you can opt for private cask sales if preferred.