When it comes to alternative investments, tequila casks are gaining attention for their promising returns and unique benefits. Whether you’re a seasoned investor or new to the world of spirits investments, understanding the key advantages of tequila casks can help you make informed decisions that align with your financial goals. In this blog, we’ll delve into the potential returns, investment terms, and tax benefits that make tequila casks an attractive option for investors.

Returns

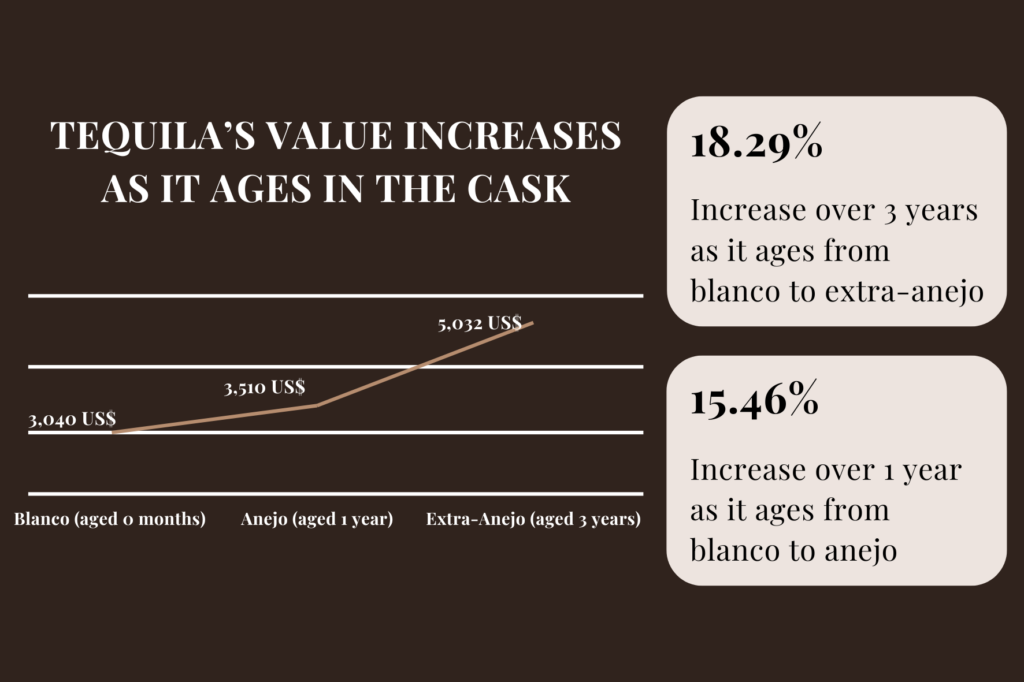

One of the primary advantages of investing in tequila casks is the potential for higher-than-average market returns. According to industry data, investors could see annual returns exceeding 15% over the next 3-5 years. These returns are largely driven by the aging process, where investors purchase casks of blanco tequila (aged 0-2 months) and allow it to mature into extra añejo (aged 3+ years) in secure storage facilities. This maturation process enhances the tequila’s quality and scarcity, making it highly valued in the market.

The projected returns are based on the average market price differentials observed between 200-liter cask prices of blanco and extra añejo tequilas, as tracked by GORDON PWC over the past 12 months. While past performance is not indicative of future results—meaning future prices could fluctuate—the current supply and demand dynamics in the industry present a favorable outlook for today’s tequila cask investors.

Valued at $16.5 billion in 2023, the tequila industry is the fastest-growing spirit category worldwide, with projections indicating it could reach $42.5 billion by 2032. This rapid growth is largely driven by a trend toward premiumization, which is increasing demand for aged tequilas like añejo (aged 1-3 years) and extra añejo. However, the industry faces significant challenges in meeting this demand due to the seven-year growth cycle of the Weber blue agave, the key ingredient in tequila, and the extended aging processes required for premium tequila.

Tequila Investment vs. Traditional Assets

Wondering if Tequila Cask is the right investment for you? Check out its performance against traditional assets!

Investment Terms

Another key advantage of investing in tequila, especially when compared to other asset classes like whisky, wine, or art, is its relatively short investment horizon. Tequila has an inherently shorter aging process, typically reaching its peak as extra añejo within three years. While there is a niche market for longer-aged extra añejos, such as 5- or 7-year-old variants, this remains a small segment, limiting the need for extended aging periods.

The demand for añejo and extra añejo tequilas, however, has surged, driving much of the industry’s recent growth. This trend is underscored by the dominance of the super-premium category, which includes the highest quality, aged tequilas and is expected to capture 55% of the market’s value by 2026. This strong market demand creates significant opportunities for investors to sell their casks for a substantial profit, especially given the challenges many brands face in securing such premium tequila. As a result, tequila investments typically operate within a 1-3 year timeframe, offering investors a quicker turnaround compared to other spirits or collectible assets.

Tax Benefits

In addition to the higher expected returns and shorter investment timeframe, investors in certain jurisdictions can also benefit from significant tax advantages associated with tequila investments, helping them retain more of their potential profits. Since tequila investments do not generate income, they would typically only be subject to tax upon the resale of the assets. However, in the United Kingdom, investors are not liable for Capital Gains Tax (CGT) on profits from the sale of tequila casks, unlike other assets such as real estate or shares.

This tax exemption exists because, like whisky casks, tequila casks are classified as ‘wasting assets,’ meaning they are not subject to CGT, regardless of whether the casks are stored inside or outside the UK. More information about this tax rule can be found on the UK Government’s website here.

Conclusion

Tequila cask investments offer a compelling combination of strong returns, relatively short investment terms, and favorable tax treatment, especially for UK investors. As with any investment, it’s crucial to do your due diligence and consult with a professional tax adviser to ensure this opportunity aligns with your financial objectives. With the tequila industry on a rapid growth trajectory, now might be an opportune time to consider adding tequila casks to your investment portfolio.

GORDON PWC launched its Tequila Cask Investment program for a seamless and safe investment process.

Our carefully curated investment pools offer a unique opportunity to own a piece of tequila history.

Join our waitlist and secure your spot before it’s too late.