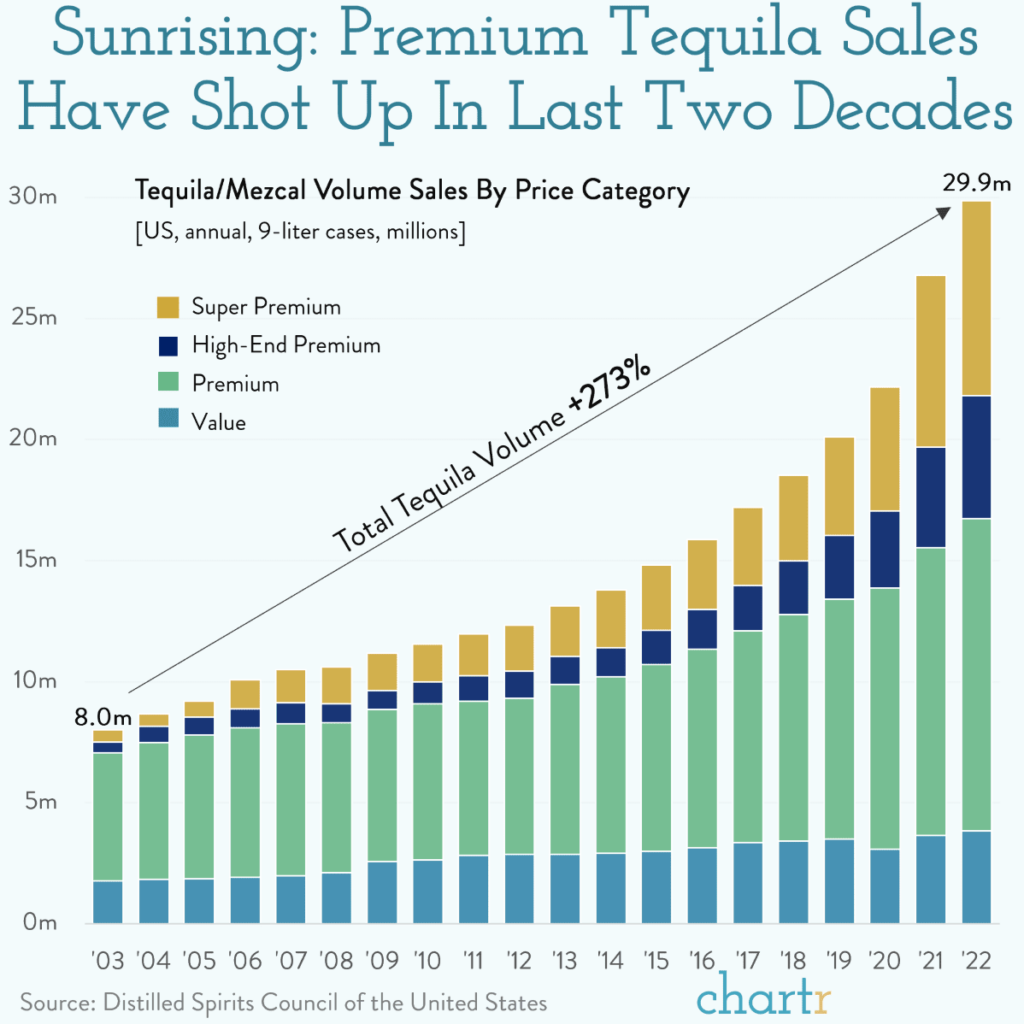

The premium tequila market is experiencing a significant boom, attracting savvy investors with its explosive growth potential.

Over the past five years, major spirits companies like Diageo, Bacardi, and Pernod Ricard have made billion-dollar acquisitions of distilleries.

High-profile celebrity investors, including George Clooney, Kendall Jenner, Michael Jordan, and Elon Musk, have further fueled market expansion and premiumization.

As of 2023, sales stand at $16.5 billion, with projections to reach $42.5 billion by 2032, growing at an annual rate of over 11%.

This rapid growth is driven by substantial investments, shifting consumer preferences towards agave-based spirits, and the ongoing trend of premiumization.

The market’s expansion is particularly strong in the premium and above categories, with super-premium tequilas—often priced above $150—leading the charge.

The agave plant, essential for tequila production, has a long growth cycle of seven years. Traditionally, most tequila has been bottled as blanco (age 0-2 months) or reposado (2-12 months), allowing for quick returns for producers.

However, the rising demand for higher-quality, aged tequilas such as añejo (1-3 years) and extra-añejo (3+ years) is driving unprecedented market growth.

This trend creates a unique short-term investment opportunity for investors to mature their own blanco tequila into añejo or extra-añejo over a period of three years.

Indicators suggest that potential profits for investors in premium cask tequila may surpass those in similar asset classes like whiskey, wine, or rum, due to favorable buy-in prices and supply-demand dynamics expected to drive prices significantly higher in the next 3-5 years.

In this article, we will outline the five simple steps involved in investing in cask tequila, including expected returns, and provide three essential tips for making smart investment decisions.

If you’re discovering this opportunity now, you could be among the early adopters ready to capitalize on this burgeoning market.

How Tequila Investment Works

Step 1: Find a Reputable Broker

Start by finding a reputable broker who acquires bulk blanco tequila in oak casks directly from distilleries in Mexico.

This provides the distilleries with the necessary cash flow to manage escalating production costs, supply chain constraints, and evolving production standards.

Step 2: Acquire Casks of Blanco Tequila

Purchase casks of blanco tequila from the broker. Ensure your advisor provides full disclosures about investment risks, costs, services provided, and potential benefits.

Verify that you receive ownership confirmation directly from the distillery, as confirmation from the broker alone is insufficient and that the broker provides a full investment service, including resale assistance.

Step 3: Age the Tequila in Bonded Warehouses

Allow the casks to age for up to three years in a government-bonded warehouse at the distillery.

During this period, you can visit your casks and receive samples. Ensure all casks are fully insured to protect against loss or destruction.

Step 4: Sell the Aged Tequila

After the aging process, preferably to añejo or extra-añejo for optimal returns, sell the tequila back to the market. Your broker’s expertise is crucial here to facilitate the sale of the casks to tequila brands.

Alternatively, investors can bottle their casks if they have the means, and some brokers can assist with this process.

Step 5: Receive Your Profits

Finally, receive your profits from the sale of the aged tequila. With the market’s current trajectory, the potential for significant returns makes premium cask tequila an attractive investment option.

GORDON PWC anticipates that its investors will achieve net annualized returns above 15% over the next 3-5 years.

Invest in the future of tequila with our periodic cask investment opportunities.

Join our waitlist and be among the first to know when the next pool opens.

What to Look for When Making an Investment in Cask Tequila

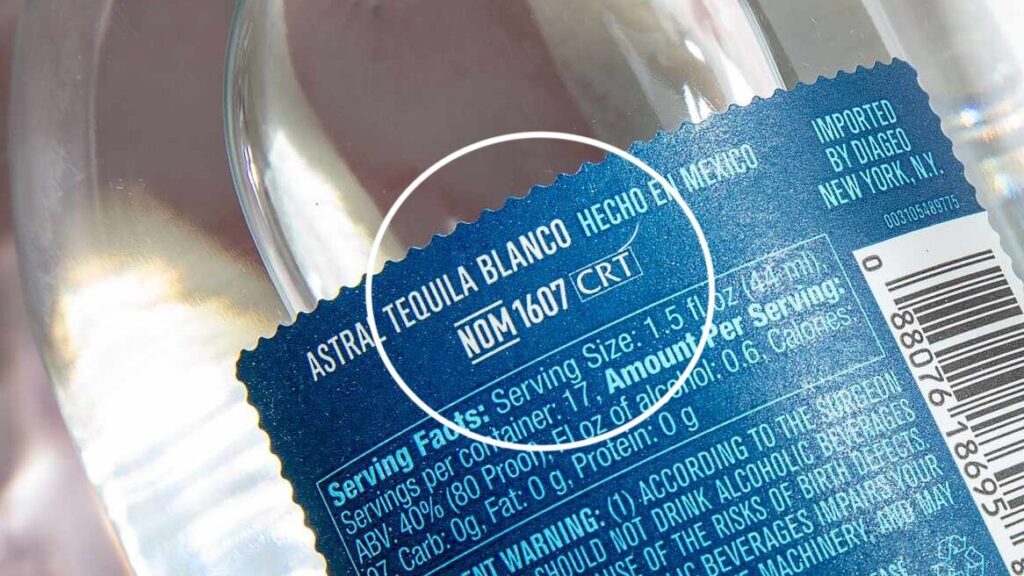

NOM Identifier

Every tequila distillery in Mexico is assigned a unique identifier known as a NOM (Norma Oficial Mexicana). This NOM, followed by four numbers, serves as a guarantee of authenticity.

While it doesn’t directly assure quality, choosing a distillery with a reputable NOM known for producing high-quality tequila brands can provide reassurance regarding the quality of your investment.

Quality

Opt for 100% agave tequila over mixto varieties for superior quality. Additionally, prioritize distilleries that employ semi-artisanal or artisanal production methods.

These traditional techniques focus on quality rather than quantity, resulting in tequilas with distinctive flavors and characteristics.

Investing in tequila produced using these methods can help broaden your resale market as it’s what the consumer desires.

Price

Your profit margins are determined by your purchase price. Avoid paying excessive broker margins by analyzing your bulk liter price.

This strategy ensures that you’re getting the best value for your investment and increases your potential for profitability when selling to brands or bottling and selling at retail prices.

Ready to Invest in Premium Cask Tequila?

If you’re ready to capitalize on this exciting investment opportunity, get in touch with us by providing your details.

Our team of experts is here to help you navigate the market and maximize your returns. Don’t miss out on becoming an early adopter in this burgeoning market—reach out to us today!