As 2025 approaches, traditional markets like stocks and bonds face increasing volatility driven by rising inflation, trade tensions, and geopolitical uncertainty. In this environment, savvy investors are turning to alternative investments to protect and grow their wealth. Casks of whisky and tequila, fine art, gold, wine, and Bitcoin are gaining attention as safe-haven assets that can help hedge against economic risks. Below, we explore these promising alternatives and their potential to deliver strong returns in a challenging market.

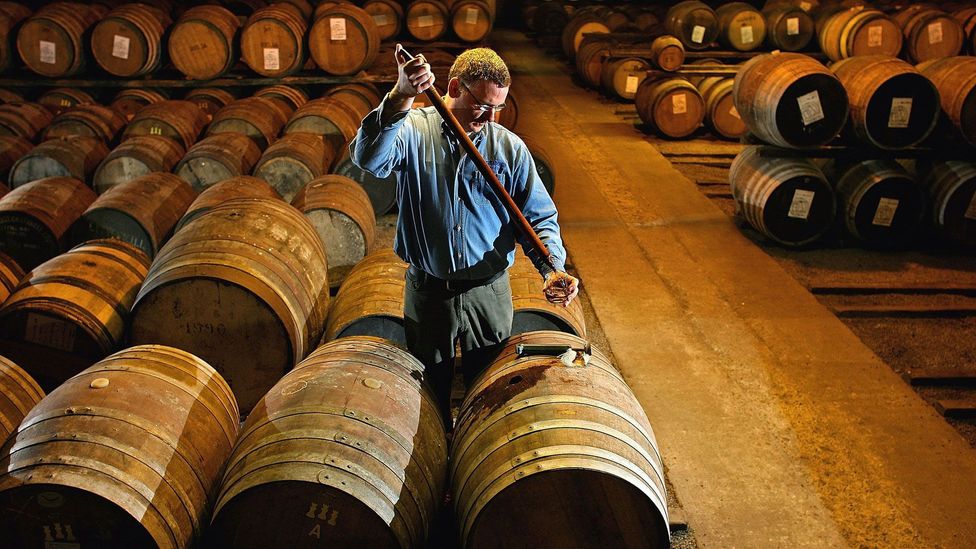

1. Cask Investments: Whisky & Tequila

Investing in whisky and tequila casks is an emerging trend, offering significant potential for capital appreciation as demand for premium spirits rises worldwide.

Whisky

Whisky continues to be a favorite among alternative investors due to its consistent value growth as it ages in the cask.

- Historical Returns: The Knight Frank Luxury Investment Index shows that the top 100 rare scotch whisky bottles sold at auction have delivered 322% growth over the past ten years.

- Inflation Hedge: During the economic turbulence of 2020-2021, rare whisky casks appreciated in value according to the BC20 Whisky Cask Index, outperforming traditional markets and providing a buffer against inflation.

- Global Demand: Growing interest in whisky, particularly in emerging markets like Asia, supports its long-term investment potential.

Tequila

Tequila, especially premium and aged varieties, has become a compelling investment opportunity.

- Market Growth: According to Yahoo Finance, the tequila market is projected to grow by 11% annually until 2032 to a value of $42.5 billion, with cask investors seeing projected returns of 13-15%, according to industry price data collected by GORDON PWC.

- Emerging Asset Class: While tequila cask investments are still relatively new, early investors are already benefiting from rising demand as tequila gains recognition as a luxury product.

2. Wine: A Classic Investment with Steady Growth

Fine wine has long been a popular choice for those looking to diversify their portfolios and hedge against inflation.

- Historical Returns: The Liv-Ex Fine Wine Index reports average annual returns of 8-10% over the past decade.

- Resilience: In 2022, despite market volatility, the Liv-Ex Fine Wine Index gained 12.6%, highlighting wine’s ability to weather economic downturns.

- Inflation Hedge: Wine’s value tends to rise as it ages, offering a tangible and relatively stable asset that is less affected by interest rate hikes and market fluctuations.

3. Art: A Tangible Hedge Against Inflation

Art has long been a favored investment for those seeking diversification and protection against inflation.

- Historical Returns: The Artprice Global Art Market Trends Report estimates that the global art market has delivered average annual returns of 5-7% over the past 20 years. Contemporary art, however, has outperformed, with annual returns exceeding 10-15%.

- Top Performers: High-profile works by artists like Banksy, Jeff Koons, and Yayoi Kusama have seen dramatic appreciation, with some pieces doubling in value within a few years.

- Why It’s Resilient: Art is not directly correlated with traditional markets, making it a reliable asset during economic instability. Its global appeal ensures a steady demand from collectors and investors alike.

4. Gold: A Timeless Store of Value

Gold remains a trusted asset for wealth preservation, especially during periods of rising inflation and geopolitical uncertainty.

- Historical Returns: Over the past 50 years, gold has delivered average annual returns of 7-8%, according to the World Gold Council.

- Inflation Hedge: Gold consistently outperforms stocks and bonds during inflationary periods. In 2022, for example, gold prices rose 5-6% while equity markets declined.

- Stability: Gold retains its value when currencies devalue, making it a go-to asset during times of economic uncertainty.

5. Bitcoin: The Digital Gold of the 21st Century

Bitcoin has transitioned from a speculative asset to a recognized store of value, offering a hedge against inflation and currency devaluation.

- Historical Returns: Since its launch in 2009, Bitcoin has delivered average annual returns exceeding 200% during its first decade.

- Recent Performance: In 2023, Bitcoin rebounded by over 80% from its 2022 lows, driven by investor concerns about inflation and fiat currencies.

- Unique Attributes: Bitcoin’s fixed supply of 21 million coins makes it immune to inflation, enhancing its appeal as a digital safe-haven asset.

Why Alternative Investments Matter in 2025

As inflation rises, interest rates climb, and geopolitical tensions persist, alternative investments offer a way to diversify and protect wealth. Each of the assets discussed—whisky, tequila, wine, art, gold, and Bitcoin—has distinct advantages:

- Whisky & Tequila Casks: Appreciate over time, driven by global demand for premium spirits.

- Wine: Offers steady returns and resilience during market downturns.

- Art: Provides a tangible, non-correlated asset with strong appreciation potential.

- Gold: Acts as a timeless hedge against inflation and currency devaluation.

- Bitcoin: Combines digital innovation with scarcity, offering protection from inflation.

Why Investing in Tequila Makes Sense During Times of Geopolitical Conflict

Geopolitical tensions can create uncertainty in traditional financial markets, leading investors to seek safe-haven assets. In such times, tequila cask investments offer a compelling alternative.

Final Thoughts

Investing in alternative assets can help you navigate the uncertainties of 2025 and beyond. These investments not only offer the potential for strong returns but also serve as valuable hedges against inflation and economic instability. As always, conducting thorough research and seeking professional advice is crucial to ensure these opportunities align with your financial goals and risk tolerance. By strategically diversifying your portfolio, you can position yourself for long-term success in an unpredictable market.