Investing in casks can be a lucrative venture, but it requires expert guidance to maximize returns. Whether you’re considering whisky investment, which matures over 10+ years and may change hands several times, or tequila investment, with its shorter 1-3 year maturation period and typically single ownership, every cask must eventually be bottled. Trading casks with integrity is essential for ensuring profitability for all parties, ultimately allowing private investors to sell to brands that meet consumer demand.

In this blog, we’ll focus on three essential aspects investors must understand to navigate the cask investment landscape and turn a profit in this burgeoning market.

1. Price

Your profit is made at the time of purchase. Beware of overpriced casks marketed for their rarity and potential high returns. Overpaying means a longer wait for returns, if any.

Tips to Avoid Inflated Prices:

- Purchase from Brokers with Direct Distillery Connections: Many brokers buy from other brokers, leading to inflated prices. To avoid excessive costs, work with brokers who have direct relationships with distilleries. While most distilleries won’t sell to private investors directly, they may work with select brokers. Verify these connections through the broker or distillery.

- Buy Unaged Spirit: This allows you to purchase casks at the lowest possible price, buying at the youngest age. For tequila investment, this means buying blanco; for whisky investment, it means purchasing new make spirit.

- Understand Margin for Growth: Use transparency in current market prices for aged casks from the same distillery to gauge your margin for growth. Compare the aged price per liter with the unaged price per liter you paid. If this data isn’t available, check aged bottle prices to estimate potential returns. However, remember that retail bottle prices generally don’t accurately reflect future value due to additional taxes, costs, and the reputation of the bottler.

Read Our Latest Posts

- The Top 5 Japanese Single Malt Whiskies to Try

- Exploring the Finest Tequilas: A Journey Through Aged Extra Añejo Bottles

- Wine Investment vs. Tequila Investment: Which is the Better Choice?

2. Quality

Quality is key to a successful cask investment. Spoilage and leakage risks, though less common today, still exist, with about 3-5% of casks spoiling. Mitigate this risk by:

Ensuring Quality in Your Investment:

- Diversify Investments: Instead of spending tens of thousands on one cask, invest in multiple barrels to spread your risk. If one barrel goes off, it’s not catastrophic. This strategy works well when buying higher volumes of unaged spirits, rather than aged ones.

- Choose Reputable Distilleries: Invest in spirits from distilleries known for their quality and craftsmanship. For example, in tequila investment, buying from NOMs (Norma Oficial Mexicana) that produce for renowned brands is a good indicator of quality, or a renowned single malt brand. Ensure that your cask has naming rights from the producer.

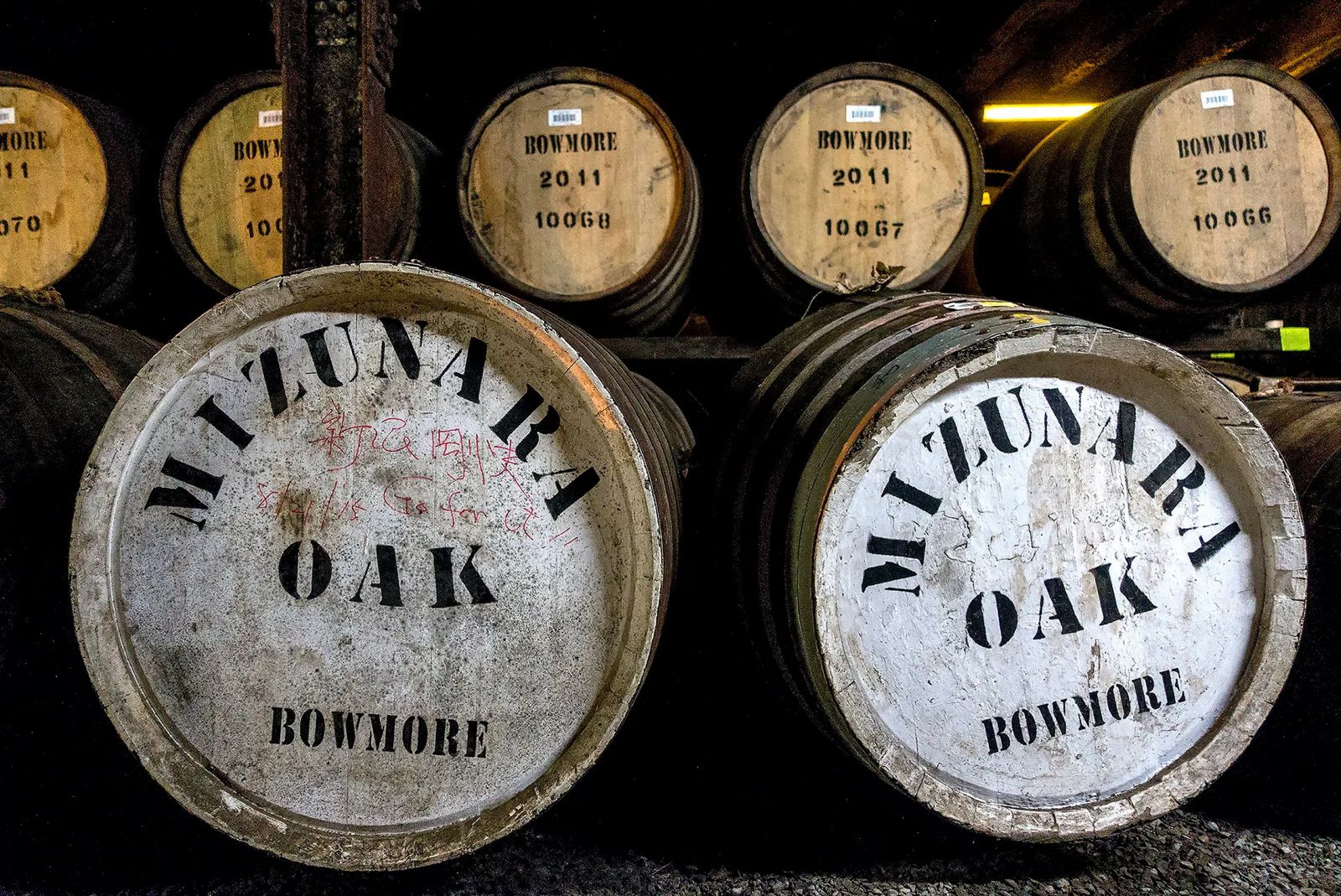

- Ensure Quality Casks for Aging: 80% of the final product’s character is derived from its interaction with the oak cask. For longer-term investments like whisky investment, buying a ‘refill’ cask is acceptable, as too long in a first fill could be overpowering. However, it might need a finish in a ‘fresh’ or ‘first fill’ cask, such as bourbon, sherry, or wine casks, to develop a more robust character. For shorter-term investments like tequila, a fresh barrel, typically ex-bourbon, should be preferred as the spirit has a shorter timeframe to develop its character.

3. Exit Strategies

Ensuring the above points strengthens your position to divest your portfolio for a profit. Your liquidity largely depends on market trends and supply and demand factors, but working with a broker who provides strong exit strategies is crucial for securing desired returns.

Tips for Effective Exit Strategies:

- Multiple Exit Channels: Look for brokers with strong exit channels, especially within the institutional buyers’ market, such as distilleries or brands. These markets offer higher liquidity as the market is vast. Brokers focusing on retail clients, mainly within the whisky investment market, offer reduced liquidity due to a smaller market.

- Test the Waters: Whisky investments require a longer timeframe to achieve optimal returns, making it challenging to test the market within a reasonable period. Tequila investment, on the other hand, allows investors to test the market within a 1-3 year period, making it a favorable avenue.

- Strong Resale Track Record: Look for brokers with a history of successful investor relations. Although past performance doesn’t guarantee returns, it can indicate the strength of the broker’s buyer network.

Conclusion

Investing in casks, whether for whisky investment or tequila investment, requires a strategic approach to price, quality, and exit strategies. By focusing on these three key aspects, you can navigate the cask investment landscape more effectively and maximize your returns. This long-term commitment, supported by expert guidance, can turn cask investments into a rewarding venture, aligning with consumer demand and market profitability.

Meet the Author

Samuel, CO-FOUNDER & CEO

As CEO and co-founder, Samuel carries forward a family legacy of passion for spirits. His journey began with Scotch whisky investments, expanding to encompass Irish and Japanese markets. Now, he brings his expertise to the US, pioneering tequila investment opportunities. Visit our blog for more insights from Samuel.