If you’ve been exploring unique investment opportunities online, you’ve likely come across numerous ads and articles touting the potential of cask investments, particularly in different types of whisky such as Scotch, Japanese, Irish whiskey, and even tequila.

This article delves into the growing allure of these options for discerning investors, providing a comprehensive overview of what’s driving interest in the category and 3 essential tips for making sound investment decisions.

What is Driving the Interest?

Supply Demand

At the heart of cask investments lies the fundamental principle of supply and demand. Demand for premium spirits, particularly exclusive craft or small-batch releases, has soared over the recent decade. The craft spirits market was valued at $20.8 billion in 2023 and is anticipated to grow at a rate of 28.1% over the next decade, reaching $247.49 billion. This growth is driven by various factors, such as changing consumer tastes, rising affluence, and increased disposable income.

Scotch Whisky and Tequila Trends

In categories such as Scotch whisky and tequila, this translates to increased demand for well-aged, single malts like Macallan, Ardbeg, or Bowmore in the Scotch category, and 100% agave, artisanal, aged tequilas like añejo and extra-anejo from brands such as Patron, Cazcanes, and Cazcabel. Notably, single malts now hold 36% of the Scotch market, up from less than 10% a decade ago. Similarly, 100% agave tequilas now account for 63% of volume and 79% of value in the tequila market, up significantly from just 29% in 2001.

Whiskey Investment vs. Tequila Investment

Explore the unique investment potentials of whisky and tequila, with a special focus on a method that has captured the attention of investors: casks, or barrels. This method leverages the maturation process, allowing investors to age their own spirits in oak barrels and capitalize on the value increase over time.

Production Challenges

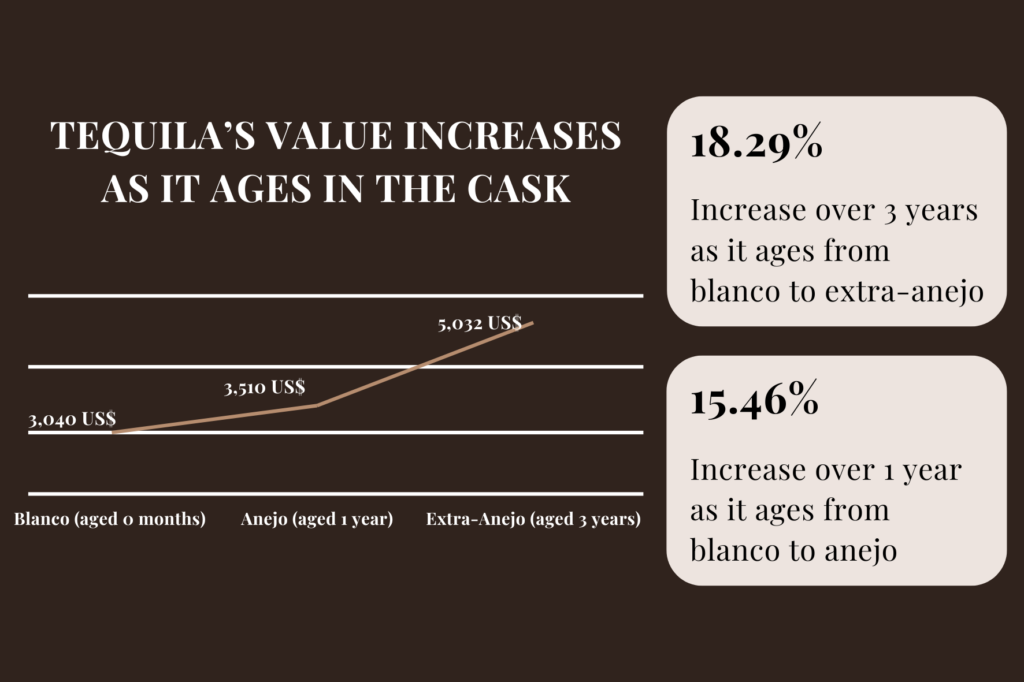

However, unlike industries such as luxury cars and rare watches, which can limit releases to enhance exclusivity and drive up prices, the spirits industry faces genuine production constraints. Producing tequila, for example, requires the blue agave plant a minimum of 7 years to mature before harvesting, followed by additional aging of 3 years or more to produce extra añejo before being bottled and sold to market. Scotch whisky similarly must spend 3 years in a cask before gaining its namesake, and then years more to reach its desired age—18 years to make an 18-year-old Scotch whisky, for example.

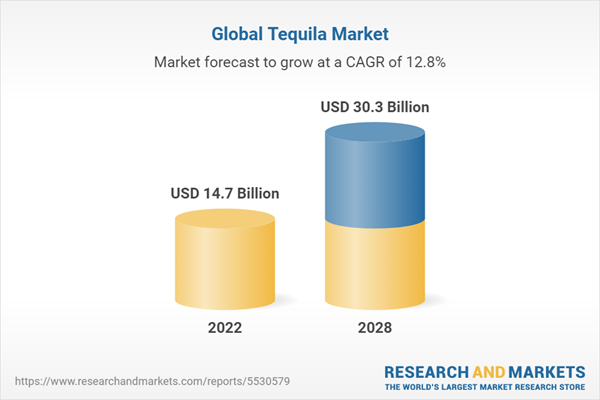

Market Growth and Constraints: These factors, coupled with the surge in demand across both categories—the tequila market was worth $16.5 billion in 2023 and is projected to reach $42.5 billion by 2032—underscore the industry’s challenges. Strict production controls, such as the denomination of origin which limits how and where Scotch and tequila can be produced, combined with limited producers, further constrain the industry’s ability to meet growing demand.

The Aging Process

The key to unlocking returns with cask investments lies in the power of the aging process. Spirits age in barrels, with aged spirits often considered superior due to the oak interacting with the spirits to create a well-rounded, complex character. The combination of increased quality and scarcity leads to greater demand and premium price points. Investors can profit from this process by purchasing new-make spirits in the case of whisky or blanco in the case of tequila, and aging them in oak casks before reselling the aged product.

Returns

Returns are never guaranteed, but cask investments capitalize on supply and demand forces driven by the aging process. Investors should typically wait at least 5 years, ideally 10 or more, for optimal returns. For instance, a case study by KPMG on a leading Irish whiskey broker showed investors achieving around 10% per annum over a 5-year period. Similarly, data from Annandale, a prominent malt distillery, indicates casks increasing in value by 11.51% annually over the first 10 years in the Scotch market. Tequila distinguishes itself with its shorter aging process and sharp price rises, as market data for trade spirits shows an increase of 18.29% over a 3-year term.

3 Essential Tips

- Buy-In Price and Broker Transparency:

- Your initial buy-in price significantly impacts potential profits.

- Avoid purchasing already-aged spirits to avoid paying inflated premiums.

- Trade with brokers directly connected to distilleries for better transparency and pricing.

- Ensure clear ownership confirmation from the distillery or warehouse where the casks are stored.

- Quality and Oak Cask Considerations:

- Quality is paramount; not all privately sold Scotch barrels meet premium standards.

- Understand the oak cask quality (first-fill vs. refill) as it often indicates the intended spirit quality.

- Exit Strategies and Liquidity:

- Ensure your broker has robust exit strategies in place.

- Look for brokers offering liquidity through direct trade channels with brands or distilleries for smoother exit processes.

Interested to learn more on how to invest in premium spirits? Make sure to read our step-by-step on How to Invest in Tequila Casks.

In summary, cask investments can offer lucrative prospects driven by rising consumer demand and production complexities. The aging process enhances spirit quality and scarcity, boosting market value. To succeed, investors should focus on strategic buy-in pricing, transparent broker relationships, and ensure they are buying the highest-quality. Robust exit strategies ensure liquidity and flexibility in navigating these dynamic markets, making cask investments a compelling option for savvy investors seeking returns in the spirits industry.

To answer the growing demand for new investment opportunities, GORDON PWC has launched a Tequila Cask Investment program.

By joining our waitlist, you can be among the first to know about our periodic cask investment opportunities