In recent years, the high-end goods market has seen a significant uptick in interest and demand. A combination of increasing global affluence, higher disposable incomes, and a few other key factors are contributing to this surge. Here, we delve into the primary drivers behind the growing allure of luxury goods.

1. Increased Global Affluence

One of the most prominent factors driving the luxury market is the rising global affluence. The number of high-net-worth individuals (HNWIs) continues to grow, particularly in emerging markets. According to the 2023 World Wealth Report, the global population of HNWIs, or individuals with assets over $1 million, has increased by 7.8% over the previous year, reaching an all-time high of over 22 million individuals. This increase in wealth has translated into higher spending power and a greater propensity to invest in high-end goods.

2. Rising Disposable Income

As economies around the world expand, disposable income levels have risen, enabling more consumers to afford luxury products. For example, in China, a key market for high-end goods, the average disposable income per capita increased by 8.2% in 2023, according to the National Bureau of Statistics. This increase in disposable income is not limited to China; many other countries, particularly in Asia and the Middle East, are witnessing similar trends.

Our limited-spot investment structure ensures exclusivity and maximizes returns.

Join our waitlist to secure your place in the next pool..

3. Shifting Consumer Preferences

Modern consumers are increasingly valuing experiences and quality over quantity. This shift in consumer behavior is particularly evident among younger generations, such as Millennials and Gen Z, who prioritize authenticity, craftsmanship, and exclusivity. Luxury brands, with their emphasis on high-quality materials, impeccable craftsmanship, and unique designs, are perfectly positioned to cater to these preferences.

4. The Role of Digital and Social Media

Digital transformation and the rise of social media have also played a crucial role in driving interest in high-end goods. Luxury brands have adeptly leveraged platforms like Instagram and TikTok to create aspirational content, engage with consumers, and showcase their products. The ability to reach a global audience and foster a sense of exclusivity and community has been instrumental in boosting the appeal of luxury items.

Read Our Latest Posts

- The Top 5 Japanese Single Malt Whiskies to Try

- Exploring the Finest Tequilas: A Journey Through Aged Extra Añejo Bottles

- Wine Investment vs. Tequila Investment: Which is the Better Choice?

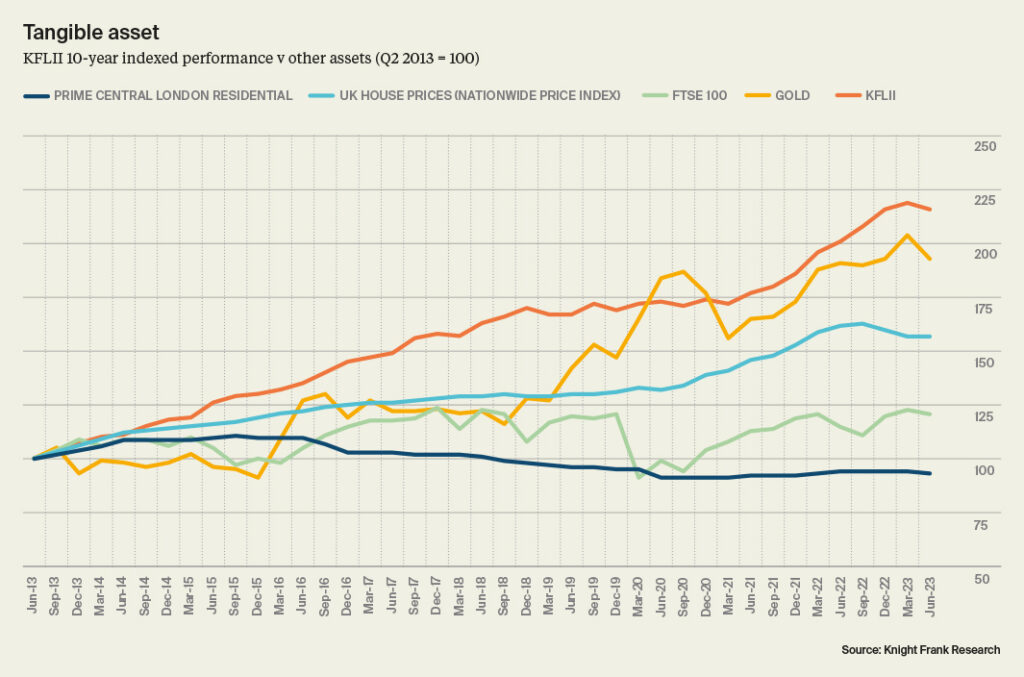

5. Economic Resilience

Luxury goods often exhibit economic resilience, remaining in demand even during economic downturns. This resilience is partly due to the status symbol associated with luxury brands. Consumers of luxury goods tend to have higher incomes and are less affected by economic fluctuations, ensuring steady demand. Moreover, luxury products are often seen as long-term investments, whether it be a vintage watch or a rare bottle of wine, further bolstering their attractiveness.

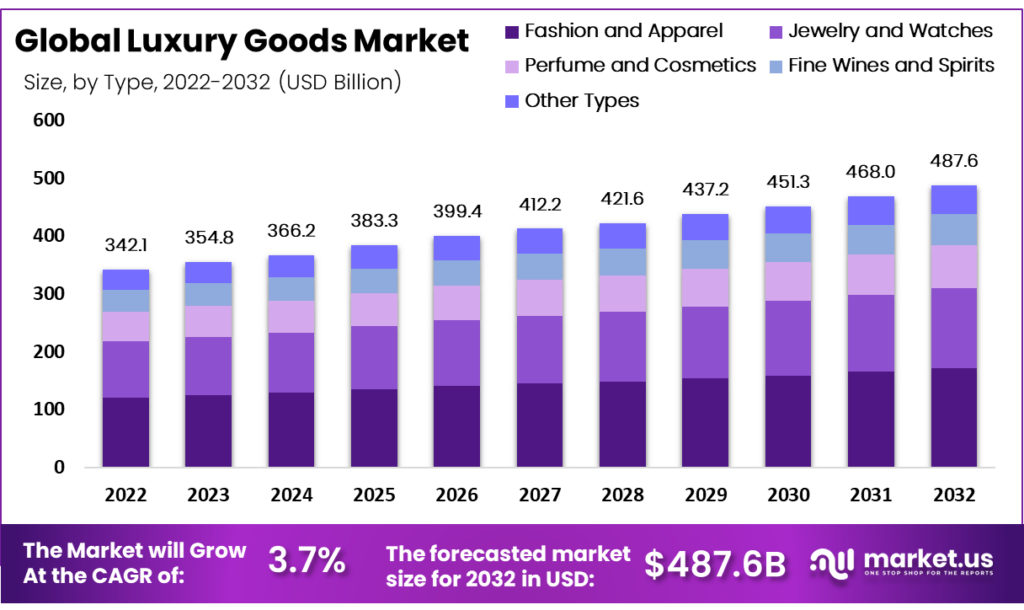

Data Insights

Here are some key data points illustrating the growth and interest in luxury goods:

- Global Luxury Market Value: The global luxury market was valued at approximately $354.8 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 5-7% over the next five years (Bain & Company).

- Asia-Pacific Region: The Asia-Pacific region is expected to account for 50% of global luxury sales by 2025, driven by rising affluence and a growing middle class (McKinsey & Company).

- Online Luxury Sales: Online sales of luxury goods grew by 27% in 2023, reflecting the increasing importance of e-commerce and digital channels (Boston Consulting Group).

Conclusion

The growing interest in luxury goods is driven by a confluence of factors, including increased global affluence, rising disposable incomes, shifting consumer preferences, and the strategic use of digital platforms. As the market continues to evolve, luxury brands are well-positioned to capitalize on these trends, offering products that cater to the desires of a discerning and affluent consumer base.

With robust economic resilience and a focus on quality and exclusivity, the luxury goods market is set to thrive in the coming years. For investors looking to enhance their portfolios with high-end goods, the combination of surging global demand and inherent scarcity stands out as a compelling driver for value appreciation.

GORDON PWC launched its Tequila Cask Investment program for a seamless and safe investment process.

Our carefully curated investment pools offer a unique opportunity to own a piece of tequila history.

Join our waitlist and secure your spot before it’s too late.