In the face of rising inflation, geopolitical instability, and tightening monetary policies, high-net-worth individuals (HNWIs) are rethinking their investment strategies. The traditional 60/40 portfolio—60% in stocks, 40% in bonds—has long been the gold standard. However, 2025’s economic climate has driven a move toward more diversified approaches. Today, up to 20% of HNWIs’ portfolios are allocated to alternatives, a stark increase from the historical 3-5%. This shift reflects a desire to preserve and grow wealth amid uncertainty.

At GORDON PWC, we specialize in premium cask investments, offering unique opportunities in an increasingly volatile world. Here’s how and why the wealthy are turning to alternative investments to fortify their portfolios.

Economic Headwinds Fueling Change

Several macroeconomic factors are reshaping investment strategies:

- Rising Inflation: Inflation reduces the value of cash and fixed-income investments, making it essential to hold assets that can appreciate in real terms.

- Geopolitical Instability: Ongoing conflicts, such as the war in Ukraine and tensions in the Middle East, disrupt global supply chains and financial markets.

- Higher Interest Rates: Central banks, like the Federal Reserve, will continue to raise rates to combat inflation, increasing borrowing costs and putting pressure on traditional equities.

The Power of Alternatives

To combat these challenges, HNWIs are turning to tangible, non-correlated assets that can withstand market volatility. Let’s explore three strong options:

1. Tequila Casks: Emerging Luxury Investment

To answer the growing demand and limited supply, GORDON PWC launched its Tequila Cask Investment program for a seamless and safe investment process.

Invest in the future of tequila with our periodic cask investment opportunities.

Join our waitlist and be among the first to know when the next pool opens.

Tequila, particularly premium and aged varieties, has surged in popularity. Like whisky, investing in tequila casks offers long-term growth potential as global demand rises. Investors benefit from:

- Scarcity: High-quality tequila is produced in limited quantities, making aged casks valuable over time.

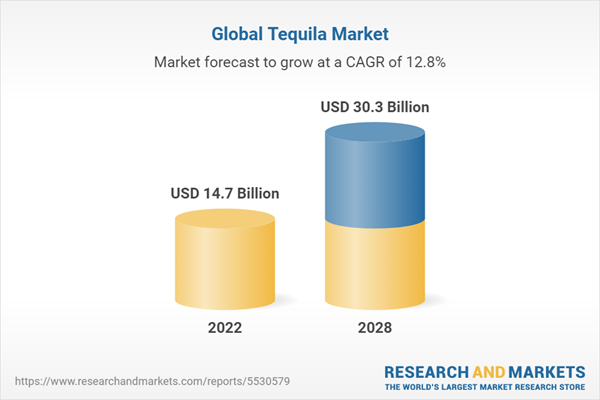

- Growing Demand: The premium spirits market, especially for premium and aged tequilas, is expanding globally.

- Strong Returns: According to Yahoo Finance, the tequila market is projected to grow by 11% annually until 2032 to a value of $42.5 billion, with cask investors seeing projected returns of 13-15%, according to industry price data collected by GORDON PWC.

2. Gold: The Ultimate Safe Haven

Gold has long been a go-to for investors seeking stability. Its appeal lies in its ability to act as a hedge against inflation and currency devaluation.

- Inflation Protection: Gold prices tend to rise during inflationary periods, preserving purchasing power.

- Liquidity and Stability: Gold is a globally recognized store of value and can be easily liquidated. Over the past 50 years, gold has delivered average annual returns of 7-8%, according to the World Gold Council.

- Crisis Hedge: During geopolitical or economic crises, gold often outperforms other asset classes.

3. Art: Timeless Value and Appreciation

Fine art, particularly works by established and emerging contemporary artists, offers both aesthetic enjoyment and financial returns. According to the Knight Frank Luxury Investment Index, art remains a resilient asset class.

- Non-Correlation: Art values do not move in tandem with stock markets, providing a buffer against financial volatility.

- Capital Appreciation: High-quality artworks have shown consistent appreciation over time, even during downturns. The Artprice Global Art Market Trends Report estimates that the global art market has delivered average annual returns of 5-7% over the past 20 years.

- Global Demand: The global art market continues to thrive, with collectors willing to pay premiums for rare, sought-after pieces.

Opportunities in Traditional Markets

While alternatives are gaining traction, certain opportunities in traditional markets remain:

- Higher Bond Yields: Rising interest rates have made bonds more attractive, offering better returns compared to recent years. For risk-averse investors, bonds can provide a reliable income stream.

- Selective Equities: Companies with strong fundamentals and pricing power may still offer growth opportunities, even in a volatile market.

A Balanced Approach for 2025

Diversification is more than just a buzzword—it’s a necessity. By combining traditional assets with alternatives like tequila casks, gold, and fine art, investors can build resilient portfolios that protect wealth while offering potential for growth.

At GORDON PWC, we help clients explore opportunities in premium cask investments, guiding them toward a balanced, future-proof strategy. Whether you’re seeking inflation protection, portfolio diversification, or long-term growth, we can help you navigate this new era of investing.

Ready to diversify? Contact us today to learn how alternative investments can secure your financial future. Let’s craft a strategy that thrives in any economic climate.