After nearly eight years in the whisky cask investment industry, I’ve had the privilege of collaborating with some of the most prestigious distilleries in Scotland, Ireland, and Japan. Throughout this journey, my primary focus has been identifying new opportunities for our clients, pioneering innovative ways to diversify their portfolios, and staying ahead of emerging trends in the spirits world.

A Shift in Focus: From Whisky to Tequila

During my time living in New York City from 2022 to 2023, I observed a significant shift in the spirits industry. Tequila, particularly 100% agave tequila, was gaining remarkable traction. Much like single malt Scotch or Japanese whisky, tequila was increasingly being appreciated as a luxury spirit, enjoyed in upscale restaurants and savored by discerning consumers. I quickly learned that this shift had been brewing in the United States for decades—it was not a fleeting trend but the evolution of tequila into a global symbol of sophistication.

Intrigued by this transformation, I delved into the world of tequila, initially from a personal consumption perspective to understand its growing appeal. As I explored the factors behind its explosive growth, it became clear that tequila holds significant investment potential. Now the number one spirit in the U.S. and the fastest-growing spirit globally, tequila’s rise has been driven by the trend of premiumization. This has fueled demand for premium-aged tequilas like añejo and extra añejo, with substantial growth now occurring outside the U.S., driven by major investments from spirits companies and high-profile figures. However, this surge in demand has also led to supply challenges, as many distilleries struggle to produce enough aged tequila to meet global demand.

Recognizing this, I saw an opportunity to introduce a new investment avenue—tequila cask investment. Similar to whisky cask investment, this concept allows investors to buy, age, and trade tequila casks, offering a unique way to tap into the burgeoning demand while supporting the industry’s growth.

Introducing a new product to the market demands rigorous due diligence, especially when navigating the unfamiliar complexities of the tequila industry. For this blog, I’ll zero in on a crucial aspect of our market analysis: ensuring comprehensive asset security and effective storage solutions for our clients throughout their investment term.

The Allure of Tequila: Understanding its Investment Potential

This analysis began when I was invited by a potential distillery partner to visit Jalisco, one of the five regions in Mexico where tequila can legally be produced. It was here that I first gained a profound appreciation for the Denomination of Origin (DO), established in 1974, with international recognition under the World Intellectual Property Organization (WIPO), which safeguards the integrity of tequila. This regulatory framework ensures that tequila is produced entirely within these designated regions, from the cultivation of the agave to the final bottling.

The DO functions similarly to the protections for Champagne in France or Scotch whisky in Scotland, where strict geographic and production standards must be met to use the name. This level of control and regulation is crucial in maintaining the quality and authenticity that help to create an attractive investment opportunity in a particular spirit.

As I explored Jalisco, I was struck by the region’s prosperity, particularly the main city Guadalajara. The stunning architecture and vibrant street life were clear indicators of a thriving $16.5 billion annual industry. Much of the income generated by the booming tequila industry is reinvested locally, fueling further growth and attracting tourists from around the globe. Tequila tourism alone is now worth over $200 million annually, with this figure continuing to rise.

The Role of NOM and CRT

A pivotal moment in my journey came when I visited the Consejo Regulador de Tequila (CRT). Much like the Scotch Whisky Association (SWA) in the whisky industry, the CRT plays a vital role in maintaining the high standards set forth by the DO that define tequila. From overseeing the planting of blue agave to regulating production processes and global marketing, the CRT’s influence is far-reaching and essential in upholding the quality and reputation of tequila.

Tequila’s Denomination of Origin (DO): An Overview

Read more about how the Denomination of Origin (DO) and the Consejo Regulador del Tequila (CRT) provides security for cask investors.

My travels also took me to the Los Altos (Highlands) region of Jalisco, known for producing some of the world’s most iconic tequila brands, like Patron and Cazcabel. Visiting my first distillery there, I was captivated by the rolling hills blanketed with fields of blue agave—the key ingredient in tequila production—a breathtaking sight that deepened my respect for the craft. Learning that these plants require a minimum of seven years to mature only reinforced the dedication and patience inherent in tequila production. Observing the jimadores—highly skilled workers who tend to and harvest the agave—was particularly memorable, as their work is not merely labor but an art form passed down through generations.

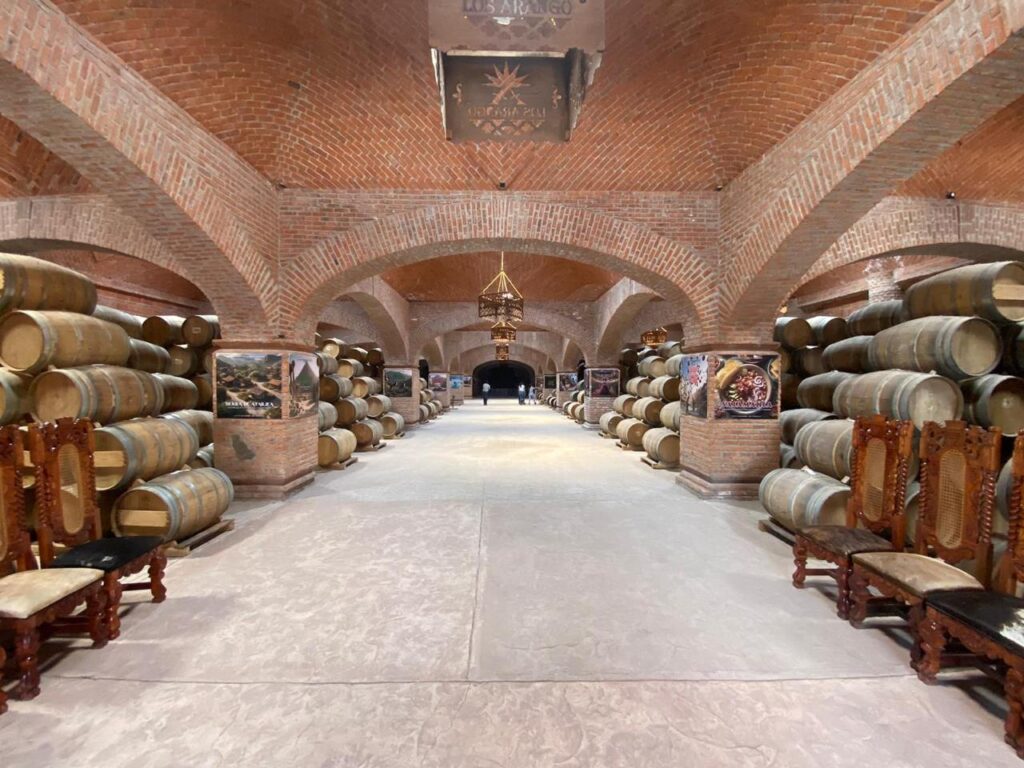

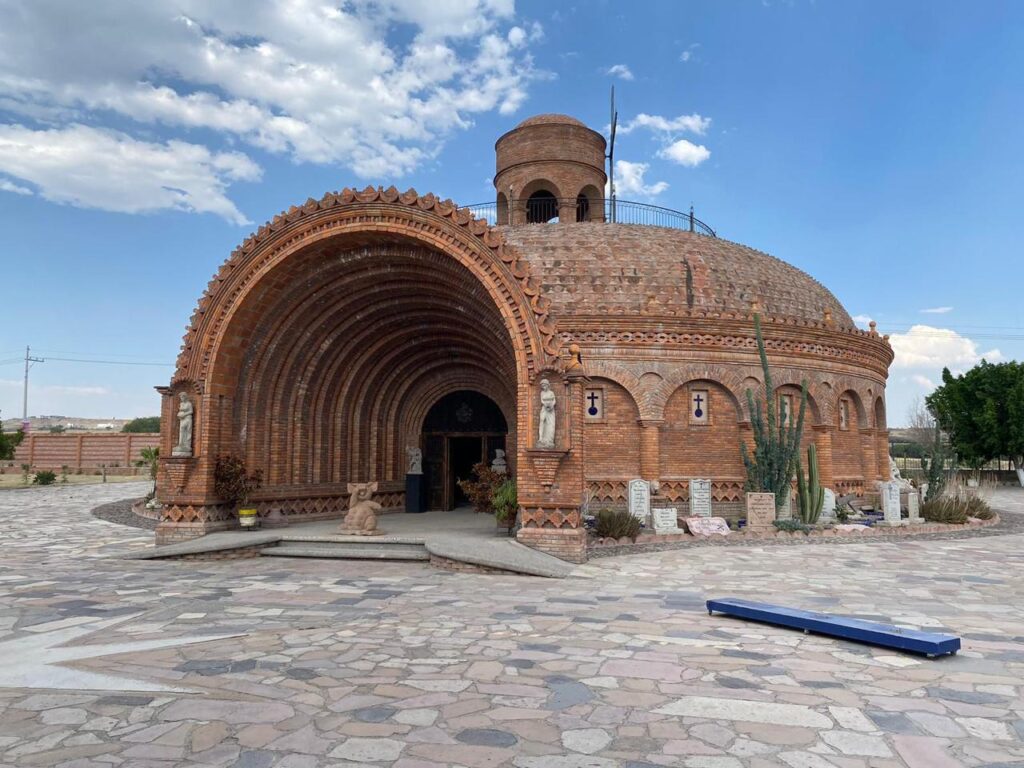

Among these agave fields, I encountered several tequileras (distilleries) that, from a distance, resembled grand estates. Upon entering a new $46.2 million distillery built for the renowned Cazcabel brand, I realized these were sophisticated tequila production facilities. The contrast between their traditional exteriors and the advanced processes inside was striking.

The attention to detail in these facilities is extraordinary. From traditional methods like using a tahona—a large stone wheel—to crush the agave, to modern techniques like mechanical crushers and autoclaves for faster production, every step is executed with precision in accordance with the strict CRT guidelines. This level of sophistication extends to the warehousing of tequila casks, where meticulous care is evident.

Each cask is sealed and registered by the CRT, then logged in a database where it is monitored until ready for bottling, similar to the HMRC’s oversight of Scotch whisky. These warehouses are designed to maintain optimal conditions and are equipped with high security and insurance measures to protect the valuable contents within.

Investing in Tequila Casks: A Lucrative Opportunity

It is understandable that many first-time investors in the tequila market, particularly those outside the U.S. who may be unfamiliar with the scale of the industry, might have reservations regarding the storage of assets in Mexico. However, understanding that the provisions set forth by the DO and enforced by the CRT have created stable conditions for the industry to thrive is crucial.

The tequila industry, now valued at $16.5 billion, accounts for close to 30% of Mexico’s food and beverage exports each year and around 3% of the country’s total exports. The industry generates significant income through taxes, primarily from exports to the United States, where around 75% of tequila is currently consumed.

The sophistication and security involved in producing and safeguarding tequila present a robust investment opportunity for our clients. Coupled with our in-depth understanding of the tequila industry’s macroeconomics, this has laid the foundation for our tequila cask investment program. The tequila market is projected to achieve a compound annual growth rate (CAGR) of over 11% up until 2032, driving annual sales to $42.5 billion. While much of this growth has been concentrated in the U.S. so far, the explosive growth rates now being seen outside the U.S., combined with the ongoing premiumization trend, set the stage for tequila’s future expansion.

Understanding the inherent supply restrictions, particularly around aged tequila that requires extended maturation after a seven-year minimum agave cycle, creates an exceptional opportunity for our clients to profit in this burgeoning market by buying, aging, and trading their own casks, thereby supporting the industry’s growth.

Final Thoughts

My journey into the world of tequila investment has been both rewarding and enlightening. I firmly believe that tequila offers a unique and promising investment opportunity. This is why GORDON PWC launched the Tequila Cask Investment program in July 2024.

Be among the first to own your piece of tequila history.

Join our waitlist and secure your spot.