You may be familiar with investing in premium spirits like whiskey, or even in other assets such as fine wine and art. However, a new contender is capturing the attention of savvy investors: premium cask tequila. Tequila is rapidly becoming the world’s premium spirit of choice, with a firm foothold in the United States and now expanding globally. In this blog, we will uncover why now is the ideal time to invest in tequila, how the investment process works, and what you need to look for to make a smart investment in this thriving market.

Why should I invest in premium tequila now?

Surging Demand

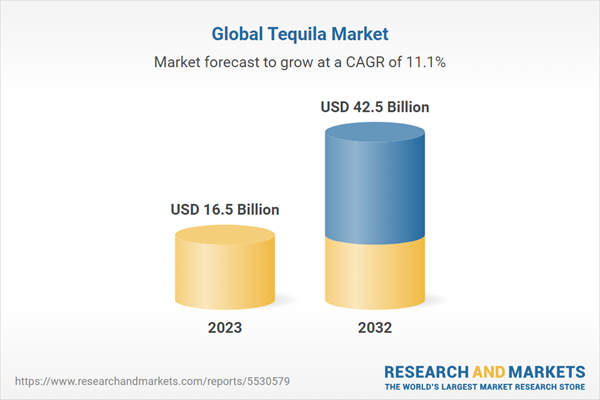

Tequila demand has skyrocketed from $2.1 billion in 2014 to $16.5 billion in 2023 and is projected to reach an astonishing $42.5 billion by 2032. This surge is driven in part by major acquisitions from big spirits giants. For instance, Bacardi’s purchase of Patrón for $5.1 billion in 2018 and Diageo’s acquisition of Casamigos for $1 billion in 2017 have significantly boosted marketing power and increased awareness for the entire tequila category.

As of 2023, tequila has overtaken whiskey sales in the United States in both volume and value and is on track to become the most sold spirit in the country by the end of 2024, currently second only to vodka. While the US has enjoyed double-digit compound annual growth rates (CAGRs) over the past decade, the highest growth rates are now anticipated in other key alcohol markets such as Canada, the UK, Spain, and Australia, where sales are projected to continue their double-digit CAGRs over the next decade.

Invest in the future of tequila with our periodic cask investment opportunities.

Join our waitlist and be among the first to know when the next pool opens.

Premiumization

Another key driver of tequila’s explosive growth is the rise of premium and above categories. Up until the early 2000s, standard tequilas, largely comprised of ‘mixtos’ (tequilas containing up to 51% agave), dominated the market. These were often minimally aged products, such as blancos aged for only 0-2 months. However, by around 2010, premium and above tequilas, typically made from 100% agave and often aged longer (1-3 years), began to gain serious traction, typically favoured as sipping drinks.

Since 2002, the super-premium category of tequila has experienced extraordinary growth, increasing by 1,522% in the US alone. In 2016, this category accounted for only 13% of volume but 33% of value. By 2026, it is projected to capture 40% of volume and 55% of value. This shift is driven by evolving consumer attitudes and economic upscaling, which have fostered a growing willingness to trade up to premium and above grades, fueling unprecedented market growth.

Additionally, celebrity investments have significantly boosted tequila’s premium status across all demographics. High-profile figures like George Clooney (Casamigos), Kendall Jenner (818), and Michael Jordan (Cincoro) have not only brought attention to tequila but have also enhanced its appeal as a luxury item.

Limited Supply

Agave, the key ingredient in tequila production, is a crucial factor contributing to the industry’s supply challenges. Tequila can only be crafted from a specific species of agave known as the Weber Blue Agave. This agave variety was carefully selected for its lengthy growth cycle, resilience against climate variations and diseases, and its high sugar content, essential for producing quality tequila.

However, several factors significantly restrict the supply of Weber Blue Agave:

- The 7-Year Growth Cycle – Blue Weber Agave is a long-cycle commodity, requiring a lengthy seven years to reach maturity. This extended growth period poses challenges for tequila production, particularly during times of low agave prices, like right now, as farmers may refrain from planting new crops. As a result, the industry struggles to maintain a balance between supply and demand, especially amidst sharp increases in tequila’s popularity.

- Denomination of Origin Tequila (DOT) – The Denomination of Origin Tequila regulation stipulates that tequila production is exclusive to five small regions in Mexico: Jalisco, Nayarit, Guanajuato, Michoacán, and Tamaulipas. This regulation covers every aspect of tequila production, from agave cultivation to bottling. While this designation ensures the authenticity and quality of tequila, it also restricts the geographic scope of production, adding to the supply limitations.

- CRT Certification Requirement – The Tequila Regulatory Council (CRT) imposes a rigorous seven-year certification process for agave plants, guaranteeing the quality and authenticity of the raw material used in tequila production. While this certification process enhances the overall quality of tequila, it further constrains the availability of agave, exacerbating the industry’s production challenges.

Investing in premium tequila is compelling due to its rapid demand growth and rising premium category, driven by major acquisitions and celebrity endorsements. Limited supply from the 7-year agave growth cycle and production restrictions further enhance its investment potential.

How does investing in premium tequila work?

- Buying Your Cask Tequila Portfolio – The journey of investing in premium cask tequila begins with acquiring your casks from a reputable broker. It’s crucial to collaborate with an experienced advisor who can tailor the investment to your specific needs and goals. Working closely with your advisor ensures that the investment aligns with your financial objectives and risk tolerance.

- Maturing the Tequila – Once you’ve acquired your casks of tequila, they embark on a journey of maturation within the distillery’s bonded warehouse. Here, the tequila undergoes aging for up to three years, transforming it from its original state, perhaps a blanco (aged 0-2 months), into a refined extra-anejo (aged 3+ years) tequila.

- Selling the Mature Tequila – When the time comes to monetize your tequila investment, you have two primary options: bottling the matured tequila yourself or selling it to a reputable brand that will handle the bottling process.

At GORDON, we understand the complexities of the tequila market and offer comprehensive assistance to our clients at every stage of the investment journey, from acquisition to resale. Our experienced team provides personalized guidance and support, ensuring a seamless and rewarding investment experience.

What to look for when making an investment in cask tequila?

- NOM identifier – Every tequila distillery in Mexico is assigned a unique identifier known as a NOM (Norma Oficial Mexicana). This NOM, followed by four numbers, serves as a guarantee of authenticity. While it doesn’t directly assure quality, choosing a distillery with a reputable NOM known for producing high-quality tequila brands can provide reassurance regarding the quality of your investment.

- Quality – Opt for 100% agave tequila over mixto varieties for superior quality. Additionally, prioritize distilleries that employ semi-artisinal or artisanal production methods. These traditional techniques focus on quality rather than quantity, resulting in tequilas with distinctive flavors and characteristics. Investing in tequila produced using these methods can help broaden your resale market as it’s what the consumer desires.

- Price – Your profit margins are determined by your purchase price. Avoid paying excessive broker margins by analyzing your bulk litre price. This strategy ensures that you’re getting the best value for your investment and increases your potential for profitability when selling to brands or bottling and selling at retail prices.

By following these key tips, you can make informed investment decisions and maximize the potential returns on your premium cask tequila portfolio. Remember to conduct thorough research and seek guidance from experienced advisors to navigate the tequila market effectively.

For more information and personalized advice on how to begin your investment in premium cask tequila, register your interest and fill in your details. Discover the lucrative opportunities awaiting you in this thriving market. Your journey towards a rewarding investment starts here!

Meet the Author

Samuel, CO-FOUNDER & CEO

As CEO and co-founder, Samuel carries forward a family legacy of passion for spirits. His journey began with Scotch whisky investments, expanding to encompass Irish and Japanese markets. Now, he brings his expertise to the US, pioneering tequila investment opportunities. Visit our blog for more insights from Samuel.