With Donald Trump back in the White House, many are already speculating about the potential global economic shifts that could follow. His first term was marked by aggressive trade policies, notably tariffs on imports from major economies like China, Mexico, and the European Union. As Trump’s administration gears up again, the possibility of similar moves is back on the table, raising concerns about how these policies could contribute to inflation and lead to higher interest rates worldwide. For investors looking to safeguard their wealth, now may be the time to consider alternative assets like whisky or tequila, which have a proven track record of offering stability and returns during inflationary times.

How Trump’s Trade Policies Could Stoke Global Inflation

During his previous presidency, Trump’s trade war with China and other nations led to increased tariffs on goods that were crucial to global supply chains. While these tariffs were meant to encourage domestic production, the ripple effect often resulted in higher costs for businesses and consumers.

Here’s why this could happen again:

- Higher Production Costs: Businesses that rely on imported goods or materials may face rising costs if tariffs are reinstated. These costs are typically passed on to consumers, meaning everyday items, from electronics to groceries, could become more expensive.

- Supply Chain Disruptions: A return to tariffs would likely cause significant disruptions in global supply chains. This is especially true for industries that rely heavily on international sourcing. Supply chain bottlenecks lead to scarcity, pushing prices up as demand outstrips supply.

- Retaliatory Tariffs: When the U.S. imposes tariffs, it often faces retaliation from its trading partners. In the past, countries hit by Trump’s tariffs responded by imposing their own duties on American products, further inflating prices and creating an economic tug-of-war that dampened global trade.

The cumulative effect of these factors could drive global inflation higher, forcing central banks to hike interest rates to counteract rising prices. This would have a domino effect, making borrowing more expensive for businesses and consumers, and could slow economic growth

Why Whisky and Tequila Make Sense During Inflation

With inflationary pressures mounting, traditional investment vehicles like stocks and bonds may struggle to keep pace with rising prices. In such an environment, alternative assets, particularly those with intrinsic value, become increasingly attractive. That’s where whisky and tequila come in. While gold and real estate have long been considered inflation hedges, rare spirits have quietly emerged as a strong contender in the world of alternative investments.

Here’s why whisky and tequila cask investments are gaining traction:

1. Tangible Asset with Long-Term Appreciation

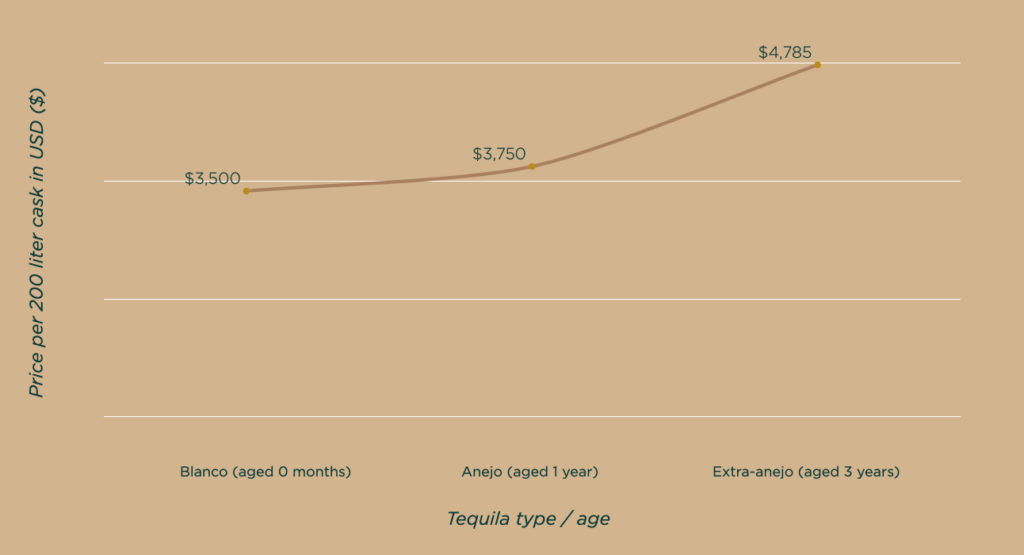

Premium whisky and tequila, particularly those aged in casks, offer a unique advantage: their value typically increases with time. Unlike stocks or bonds, which can be heavily influenced by market volatility, the aging process for spirits like whisky and tequila naturally adds value. The longer these spirits age, the rarer and more sought-after they become, driving up prices—often significantly.

For example, an aged whisky from a renowned distillery can fetch extraordinary prices on the secondary market, especially as global demand for premium spirits grows. The same is true for high-quality tequila, especially given its rising popularity in markets like the U.S. and Europe. As long as the spirit is stored correctly, it will continue to mature in value.

2. Non-Correlation to Traditional Markets

One of the biggest draws of investing in whisky or tequila casks is that their value is not tied to the performance of the stock market or even interest rates. In times of economic instability, traditional assets may struggle, but the value of premium aged spirits tends to remain strong. This makes them an excellent hedge against inflation and a valuable diversification tool for any portfolio.

Moreover, premium spirits often have a steady demand, particularly from collectors and luxury consumers. Even during economic downturns, people seek out rare and exclusive products, and the scarcity of well-aged whisky or tequila only adds to their allure.

3. Inflation Hedge

Much like real estate or precious metals, whisky and tequila act as a hedge against inflation. When inflation rises, the purchasing power of cash declines, but the value of tangible assets like cask-aged spirits often remains stable—or even increases. This is because the value of these spirits is not dependent on fiat currency but rather on their scarcity, quality, and age.

As inflation eats away at the value of money, the appeal of hard assets grows. Investors are increasingly looking for stores of value that can maintain or grow their wealth during inflationary periods, and whisky and tequila casks fit the bill perfectly.

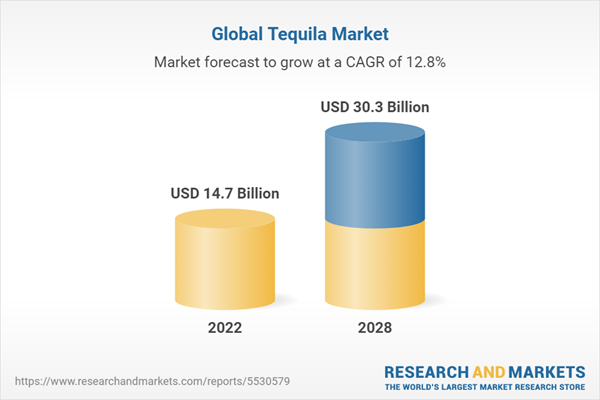

4. Growing Demand for Premium Spirits

In recent years, there has been a surge in global demand for premium aged spirits. Whisky has long been a favorite of collectors and connoisseurs, but tequila has seen a meteoric rise in popularity, particularly in the U.S., where artisanal and aged varieties are becoming highly coveted. This growing demand bodes well for cask investors, as prices for well-aged spirits continue to climb in response to the limited supply.

In markets like Asia, where luxury goods are seen as status symbols, demand for rare and exclusive whisky and tequila is on the rise. This trend is expected to continue, providing investors with a lucrative opportunity for capital appreciation.

Invest in the future of tequila with GORDON PWC exclusive cask investment program.

Be prepared

Join our waitlist and secure your spot before it’s too late.

Navigating Uncertain Times with Smart Investments

With Trump back in the White House and the potential for a return to tariffs and trade tensions, the global economy may face renewed inflationary pressures. As central banks respond by raising interest rates, traditional investments could struggle to keep up. However, alternative assets like whisky and tequila casks offer a unique opportunity to protect wealth and even generate returns during periods of inflation.

By investing in these tangible, appreciating assets, savvy investors can shield their portfolios from the effects of rising prices and enjoy the added benefit of owning a piece of the growing global demand for premium spirits. In uncertain times, whisky and tequila might just be the safe-haven investments that make all the difference.

Meet the Author

Drawing on a rich background in finance and investments, Marc honed his focus on premium cask investments after a fortuitous encounter with Samuel.

Based in Dubai, he has risen as a market innovator in the Middle East and the Gulf.