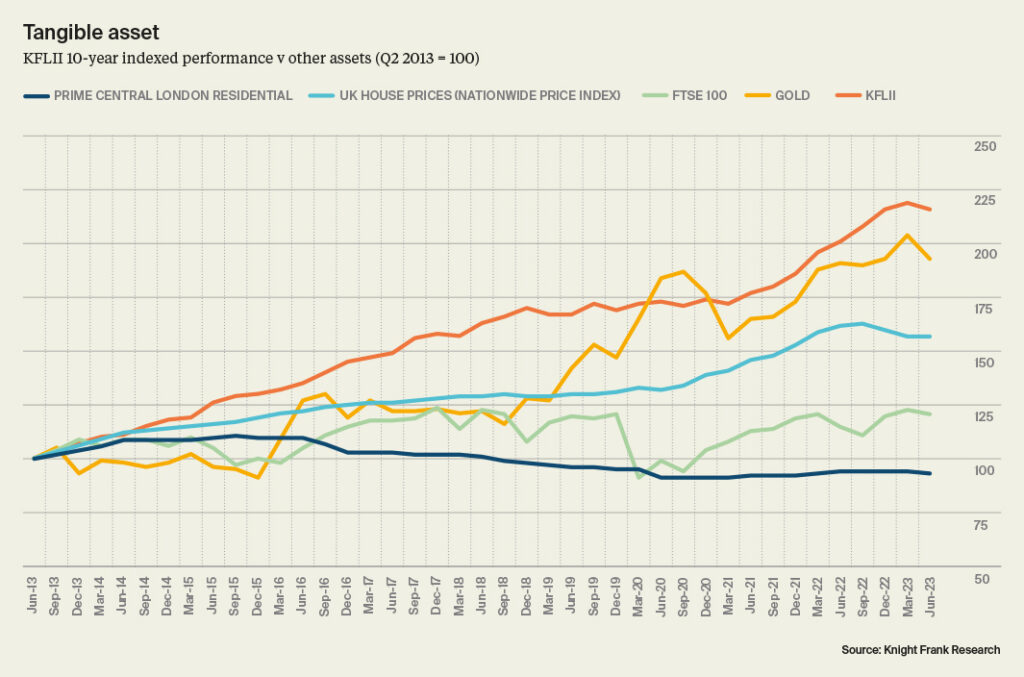

In today’s unpredictable economic climate, discerning investors are seeking diverse and unique opportunities to grow and protect their wealth. One increasingly popular avenue is the premium spirits market.

For this blog, we will delve into the world of whisky and tequila investments, with a special focus on a method that has captured the attention of investors: casks, or barrels. This method leverages the maturation process, allowing investors to age their own spirits in oak barrels and capitalize on the value increase over time.

The aging process significantly enhances the desirability of these spirits. As whisky and tequila mature in casks, they develop a more complex and rounded character, which is perceived as higher quality. Additionally, the scarcity of well-aged spirits further drives demand and value.

Join us as we explore the unique investment potentials of whisky and tequila. We’ll uncover the similarities and differences between these esteemed industries and how they can serve as lucrative investment products.

So how does whisky and tequila as an investment stack up against each other?

Returns & Investment-Terms

Scotch Whisky

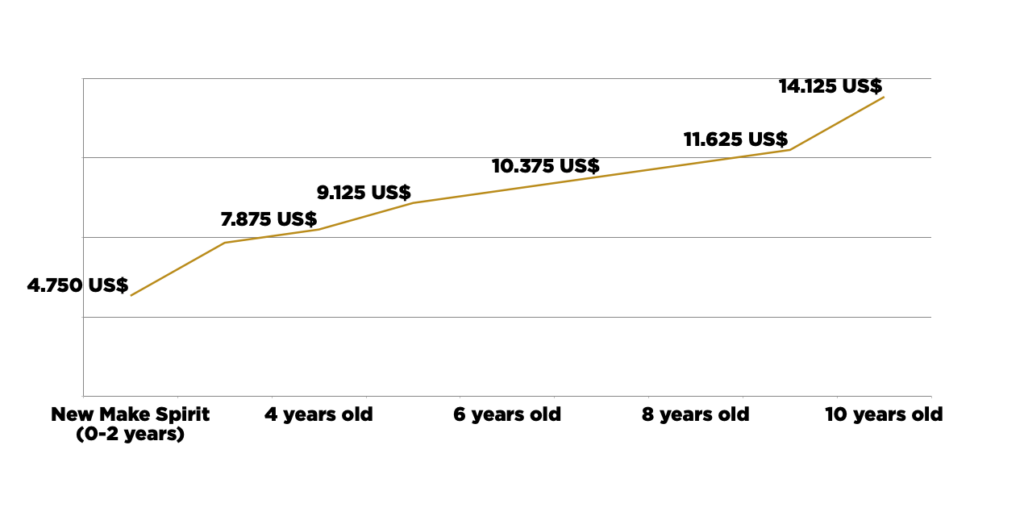

According to data from the renowned Annandale distillery, casks of Scotch whisky deliver impressive returns of 11.51% over a 10-year period. This steady appreciation is driven by the maturation process, which significantly enhances the spirit’s complexity and desirability.

As Scotch ages, particularly beyond 15 years, it becomes increasingly rare, with bottles and casks from the 20-year mark commanding exceptionally high prices. The steady rise in value over a long period is a hallmark of Scotch whisky investments.

Tequila

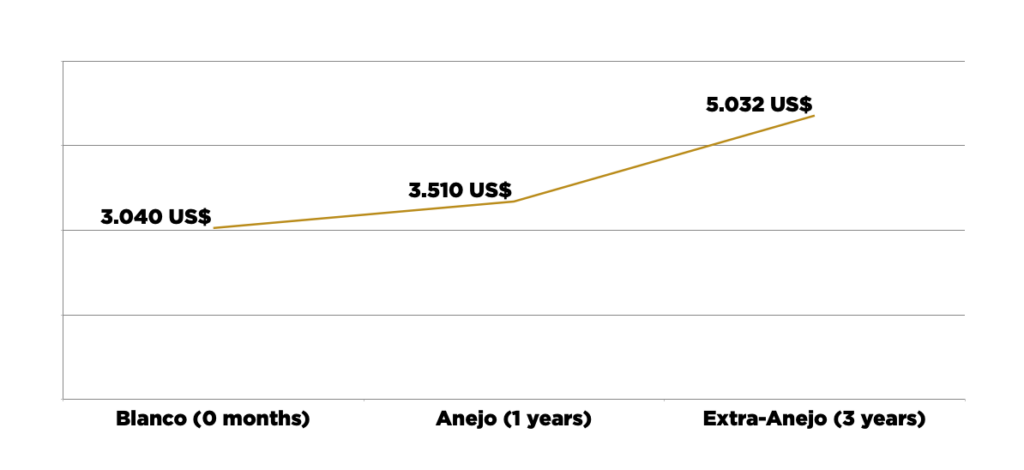

Data from NOM #1436, a leading tequila producer known for the iconic Cazcabel brand, indicates that tequila cask investments can achieve returns of 18.29% over just a 3-year period. These higher short-term returns are attributed to the sharp price increases for Añejo (aged 1 years) and Extra-Añejo tequila (aged 3 years).

Unlike Scotch, most tequila is bottled as Blanco (0-2 months) or Reposado (2-11 months), making aged tequilas like Añejo and Extra-Añejo significantly scarcer and more valuable. The rapid increase in value for aged tequilas offers investors a lucrative and quicker return compared to Scotch whisky.

Market Demand

Whiskey and Tequila Market Growth

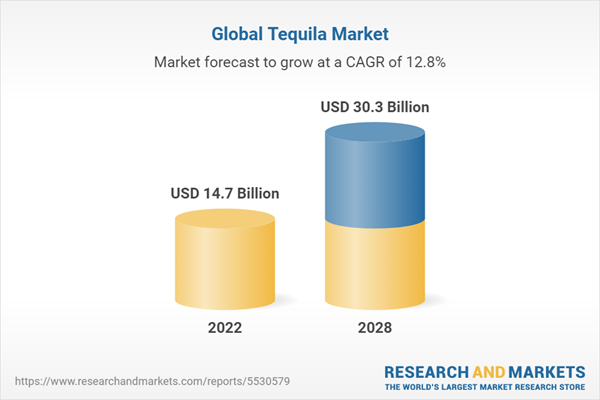

Market demand is a crucial factor driving the growth of investments in whisky and tequila. Without sustained demand, oversupply could lead to price drops.

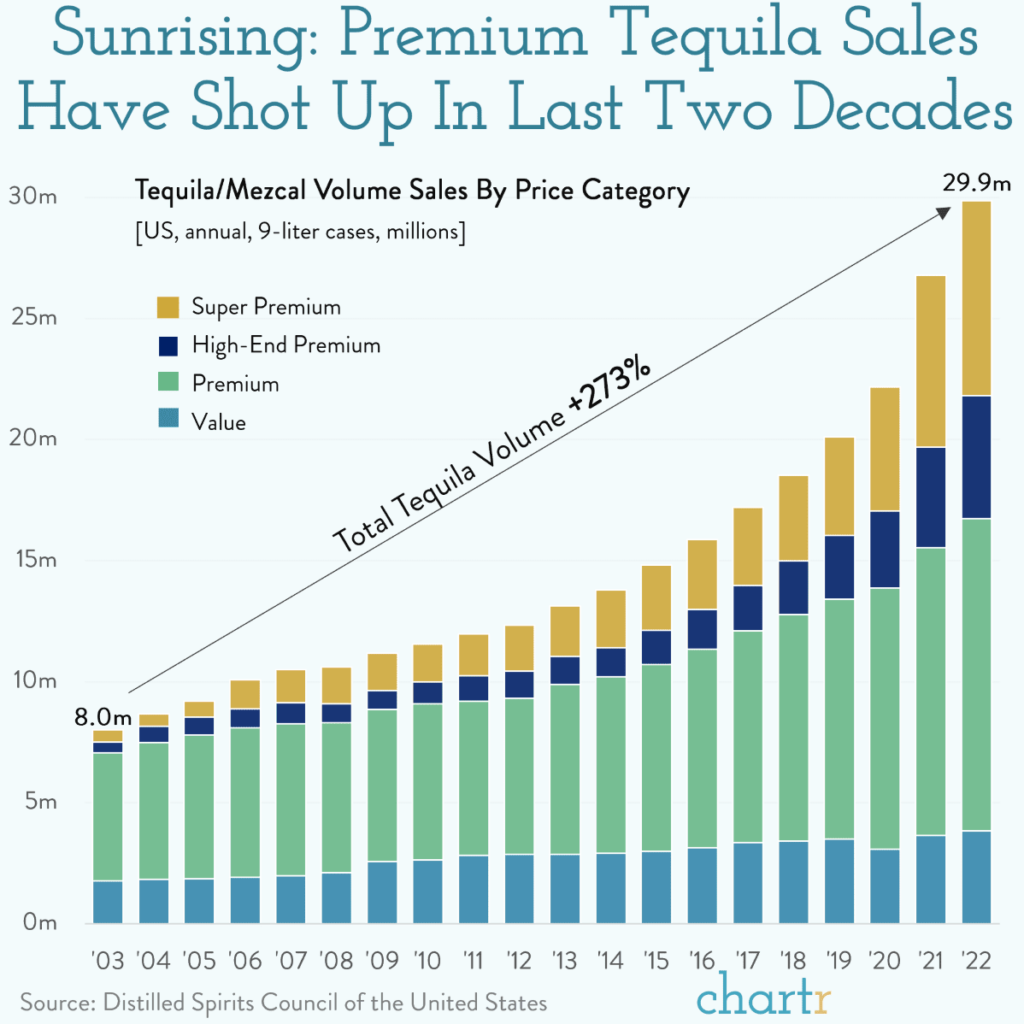

Fortunately, both markets are experiencing unprecedented demand. In 2023, tequila sales reached $16.5 billion, while whisky sales surpassed $7.5 billion. This growth is predominantly driven by the premium-and-above categories.

Premium Scotch Whisky Market

Scotch whisky is also seeing significant growth, particularly in the single malt category. In 2023, demand for single malts grew to $2.02 billion, now accounting for 36% of the market, a substantial increase from around 8% a decade ago.

The demand for high-quality, aged Scotch continues to rise, driven by the same factors of rising affluence, increased disposable income, evolving consumer tastes and strong marketing campaigns from well-established brands.

Premium Tequila Market

The tequila market is currently experiencing explosive growth, especially in the super-premium category. This segment, which includes the highest quality 100% agave tequilas, aged tequilas like Añejo and Extra-Añejo, and artisanal small-batch releases, is on track to dominate the market.

By 2026, it is expected to hold 55% of the market’s value and 40% of its volume, with bottles regularly commanding prices over $100. Significant investments from big spirit companies, celebrity brands, rising affluence, increased disposable income, and changing consumer preferences in key markets like the United States, Asia Pacific and Middle East are key drivers behind this surge in demand.

Supply Challenges

Scotch whisky

Scotch whisky production involves a relatively streamlined process, where barley, the primary ingredient, can be harvested within 3-4 months and swiftly used in distillation. However, Scotch must age for a minimum of 3 years per regulations set by the SWA (Scotch Whisky Association) to ensure product quality and integrity.

Meeting the soaring demand for aged single malts, such as 12, 15, or 18-year-old expressions, poses a significant financial burden for distilleries and brands, given the lengthy maturation period required—a minimum of 18 years for an 18-year-old whisky.

To manage this challenge, distilleries often employ innovative marketing strategies, such as releasing NAS (No Age Statement) bottles with evocative names like ‘Estate’, ‘Gold’ or ‘Reserve’, which have become increasingly prevalent in recent years and is a sign of undersupply of aged stock—a consequence of the meteoric rise of single malt scotch whisky over past two decades.

Tequila

Tequila production faces its own set of challenges, primarily centered around the scarcity of its key ingredient, the Weber Blue Agave plant. This native Mexican species takes 7-10 years to mature before it can be harvested for tequila production.

Consequently, producers typically sell their tequila young, either as Blanco or Reposado within 11 months, to meet immediate market demand. As the entire industry experiences rapid growth, meeting the escalating demand, particularly in the booming super-premium segment, comprising well-aged tequilas, remains a critical concern.

Moreover, tequila production is strictly regulated under the Denomination of Origin, akin to Scotch or champagne, mandating that it be produced exclusively in Mexico and within 5 small regions. These stringent regulations encompass all aspects of production, including the sourcing of raw materials like the blue Weber agave, which must also be grown locally.

With only 75 distilleries in Mexico catering to approximately 2800 brands, acquiring production licenses is exceptionally challenging, further constraining supply in this burgeoning market.

Liquidity

Scotch

Liquidity is a crucial factor for investors in any market, and the spirits market is no exception. In the Scotch whisky market, liquidity can be somewhat restricted. Investors typically trade casks among themselves until the whisky is ready to be bottled, which limits the resale market size.

Additionally, each cask must eventually be bottled, and distilleries rarely buy back their casks. This often leaves investors with the option to either bottle the whisky themselves or sell it to independent bottlers, which represents only a fraction of the overall market.

Tequila

On the other hand, the tequila market offers significantly higher liquidity. Investors can sell their aged tequila casks directly to brands for bottling, facilitating a more straightforward and efficient transaction process. In this market, investors serve as intermediaries between distilleries, which produce and age the tequila, and brands that require aged spirits for their products.

Notably, over 95% of tequila brands that make up the vast majority of the market do not own distilleries or have storage facilities, relying instead on a buy-to-bottle strategy. This reliance on external sources for aged tequila creates a robust demand, ensuring a more liquid market for investors.

Conclusion

In conclusion, both whisky and tequila present compelling investment opportunities, each with its unique advantages and challenges. Scotch whisky is ideal for investors seeking steady, long-term returns, while tequila offers higher short-term returns and greater market liquidity. By understanding these dynamics, investors can make informed decisions and capitalize on the growing demand for premium aged spirits.