With GORDON PWC headquartered in Dubai and many of our clients spread across the Gulf and the Middle East, we feel it’s important to highlight why investing in tangible assets—such as tequila casks, gold, or whisky—can be a smart move during times of war, especially in regions affected by geopolitical conflict.

In this article, we’ll explore how economic and financial uncertainty caused by conflict, including fluctuating oil prices, makes tangible assets like tequila casks an appealing option for investors.

Economic Instability in Geopolitical Crises

War’s Impact on Markets

Wars create significant volatility in financial markets, often leading to disruptions in traditional investments like stocks and bonds. In times of uncertainty, investors tend to flock to safe-haven assets with intrinsic value. Tangible assets, like tequila casks, fit into this category, providing a hedge against the instability seen in other markets.

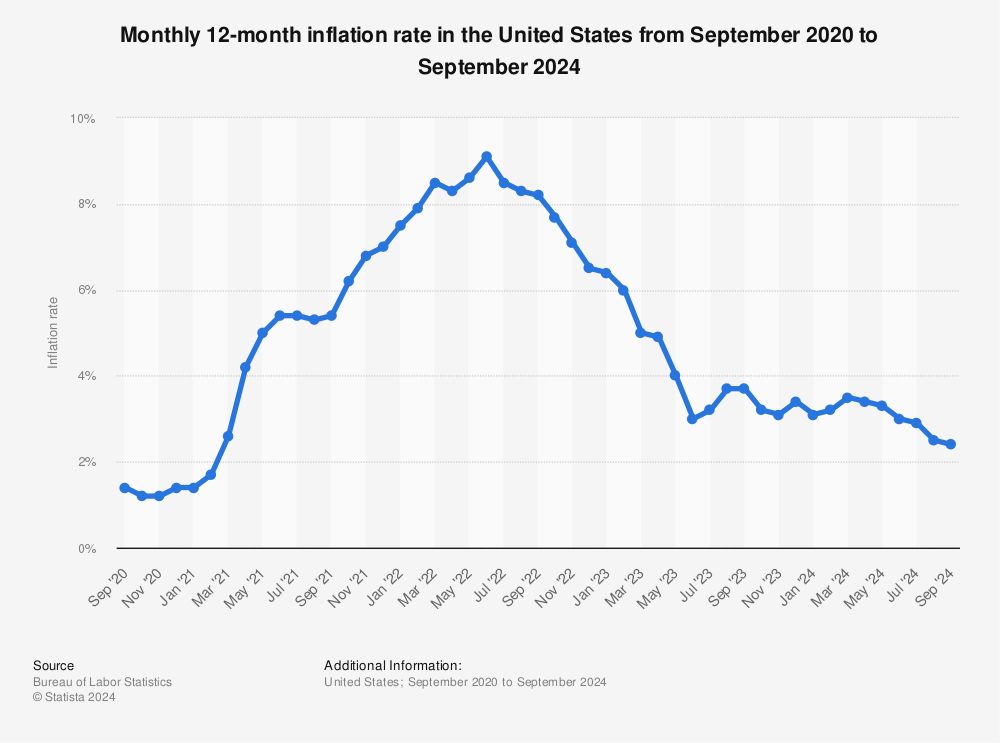

Inflationary Pressures

Geopolitical conflicts often result in increased government spending, inflation, and currency devaluation. For example, inflation in countries such as the U.S. and Dubai remain high, with the Consumer Price Index (CPI) rising 3.7% and 4.27%, respectively, year-over-year as of September 2024. When paper assets lose value due to inflation, tangible assets like tequila casks can maintain or even appreciate in value, making them an effective inflation hedge.

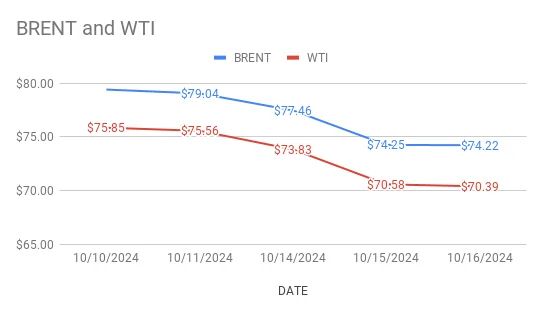

The Role of Oil Prices in Geopolitical Conflict

Oil Price Volatility

Geopolitical tensions, especially in oil-rich regions, often lead to fluctuations in oil prices. Currently, oil prices recently surged past $80 per barrel, with the potential to rise further towards $100 amid ongoing tensions in the Middle East. Historically, rising oil prices have signaled economic turbulence, driving investors to seek alternatives like gold or other tangible assets.

Tequila Casks as Inflation-Resistant Investments

As oil prices increase, production and distribution costs in various industries rise, feeding into broader inflation. However, tequila casks, as a physical asset, are less affected by short-term inflationary pressures. As the spirit ages in oak barrels, its value increases over time, providing a buffer against economic headwinds driven by rising oil prices.

GORDON PWC launched its Tequila Cask Investment program for a seamless and safe investment process.

Our carefully curated investment pools offer a unique opportunity to own a piece of tequila history.

Join our waitlist and secure your spot before it’s too late.

Tangible Assets vs. Paper Investments During War

Control Over Investments

During geopolitical crises, paper investments like stocks, bonds, or currencies are subject to wild fluctuations and government interventions, such as capital controls or trade restrictions. In contrast, tangible assets like tequila casks offer more stability, as their value isn’t tied to financial markets or government policy.

Store of Value in Times of Crisis

History shows that tangible assets—whether it’s gold, real estate, art, or casks of aging spirits—maintain their value during political or economic crises. For instance, during the financial instability of 2008, gold surged in value, offering protection when stocks plummeted. Similarly, tequila casks can act as a store of value, appreciating as the spirit matures.

Diversification of Risk

Non-Correlation with Traditional Markets

One of the key benefits of investing in tequila casks is their lack of correlation with traditional financial markets. Stocks, bonds, and commodities often react sharply to geopolitical events, but tequila casks offer a way to diversify a portfolio and reduce exposure to market volatility. This makes them particularly appealing when global tensions are high.

Protection Against Market Volatility

As an asset with its own intrinsic value and growth trajectory, tequila casks can provide protection against the swings seen in traditional markets during geopolitical turmoil. Even as markets experience uncertainty, tangible assets like these can offer stability and potential long-term growth.

Tequila Casks as a Safe Haven Asset

Durability and Intrinsic Value

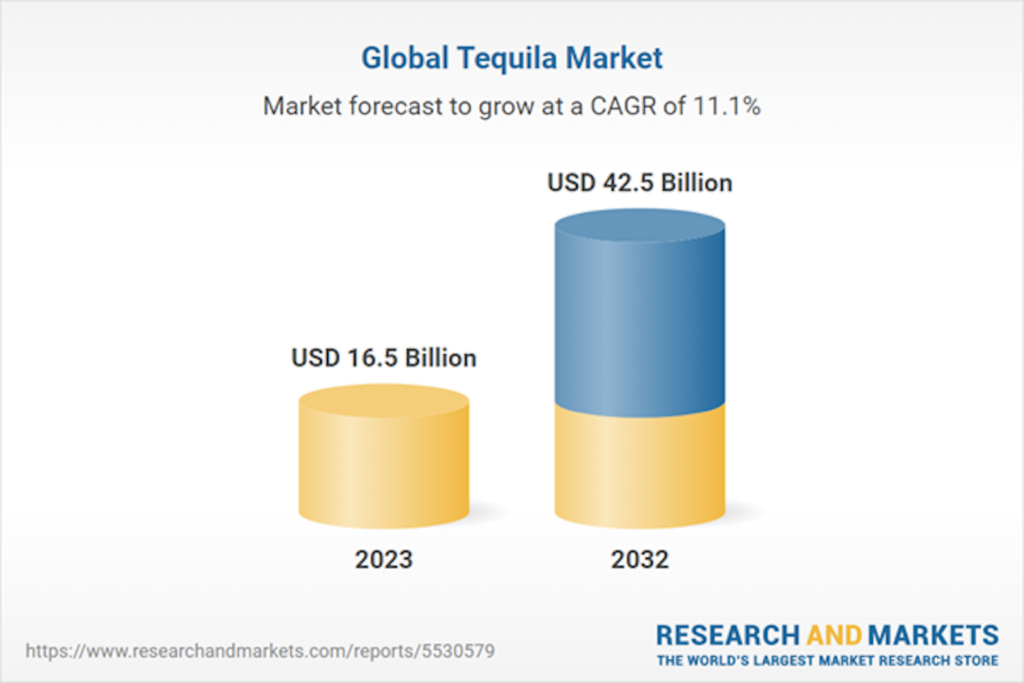

Tequila casks are more than just a commodity—they are an appreciating asset. As the tequila ages, its value rises, much like wine or whisky. This is not subject to the day-to-day fluctuations of the stock market. With the tequila market expected to grow by over 11% annually over the next eight years, the demand for aged tequila continues to rise, making it an increasingly valuable asset.

Why Invest Now?

Current geopolitical tensions in the Middle East, coupled with rising oil prices, present both risks and opportunities for investors. Tequila casks, as a tangible asset, offer a stable, inflation-resistant investment option with the potential for high returns. As the global demand for premium spirits grows, investing in tequila casks today can provide a significant opportunity for portfolio diversification and wealth preservation, even in uncertain times.

Meet the Author

Drawing on a rich background in finance and investments, Marc honed his focus on premium cask investments after a fortuitous encounter with Samuel.

Based in Dubai, he has risen as a market innovator in the Middle East and the Gulf.